I am trying to get better at adding to my winners rather than my losers, but here I am still drawn to stocks where the valuation becomes more reasonable aka the stock is down big. The key question to determine is whether the business is facing short term headwinds or if there something fundamentally broken with the core of the business. I find that writing my thoughts down helps differentiate between the two and helps determine the root cause of the price action. This allows me to set the key criteria I am watching, which will then determine whether I continue to hold, sell, or even allow me to average down into a better risk/reward setup. I have been too prone to average down in the past and am seeking to do a better job of looking under the hood of the company. I will never be able to perfectly time when the stock will “bounce” or “rebound”, but I do not want to continuing holding stocks where management is saying one thing, but actually doing another thing. I have written updates on Evolution and Teqnion that has greatly helped me differentiate the market noise from the signal. In this post, I will look at Computer Modelling Group following the below outline.

Introduction

Investment Thesis

Valuation

Financial Snapshot

Outlook

1. Intro

Back in the end of 2024, I became excited when I read that Chris Mayer had invested in a new company, Computer Modelling Group, $CMG.TO (not to be confused with CMG 0.00%↑ Chipotle). I am very familiar with his investing style and understand that he holds a very high bar, rarely adding new names to his portfolio. I was generally familiar with the company, but my first mistake was following along without doing enough of my own due diligence upfront. My second mistake was sizing up the position too quickly rather than waiting for the stock to settle. Let’s dive into where Computer Modelling Group (“CMG”) currently stands. Do I need to cut ties altogether or is today’s price of $7.5 CAD at an attractive valuation?

Below is a snippet of the interview with Chris Mayer, which kicked off my initial interest in the company. (Reference: This interview was given back when the stock was ~$10/share)

Can you give us an example of a company you found an especially compelling investment opportunity, and what specific characteristics drew you to it?

One stock I bought recently is Computer Modelling Group, listed in Canada. There is a certain Constellation Software influence here; Mark Miller is chairman of the board. The largest shareholder is a Constellation board member. And the head of acquisitions is an ex-CSI guy. The CEO, Pramod Jain, gets it.

Early in 2024 they adopted CSI-style compensation, which rewards ROIC + growth and requires part of the bonus to purchase shares in the open market. I love all of this. And then you have a steady, high-return, cash-spinning, moaty software business at the core. They've got lots of room to deploy capital in a big market and grow.

One negative is the dividend. But I'd expect them to cut or do away with the dividend entirely at some point as they ramp up their M&A program. They've only done two so far. The stock sold off heavily after a soft quarter in November, which is a gift for the longer-term shareholders.

So, yeah, this one has the whole package – great incentives, great team, great balance sheet, high returns, lots of room to deploy capital – and now, because of the selloff, a very good valuation to boot. I even like the boring, non-promotional name. It's a sleep-well-at-night investment for me and I expect to own shares for a long time.

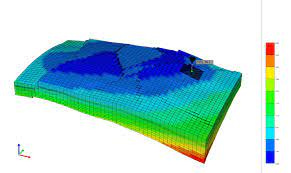

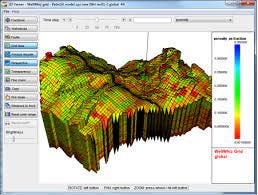

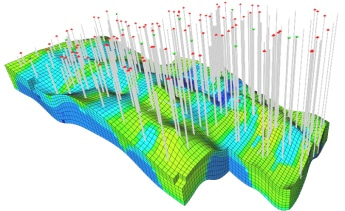

CMG, a software and consulting technology company, engages in the development and licensing of reservoir simulation and seismic interpretation software and related services. The company was founded in 1978 and is headquartered in Calgary, Canada. CMG has loads of experience in reservoir simulation software and a strong market presence in this dynamic landscape.

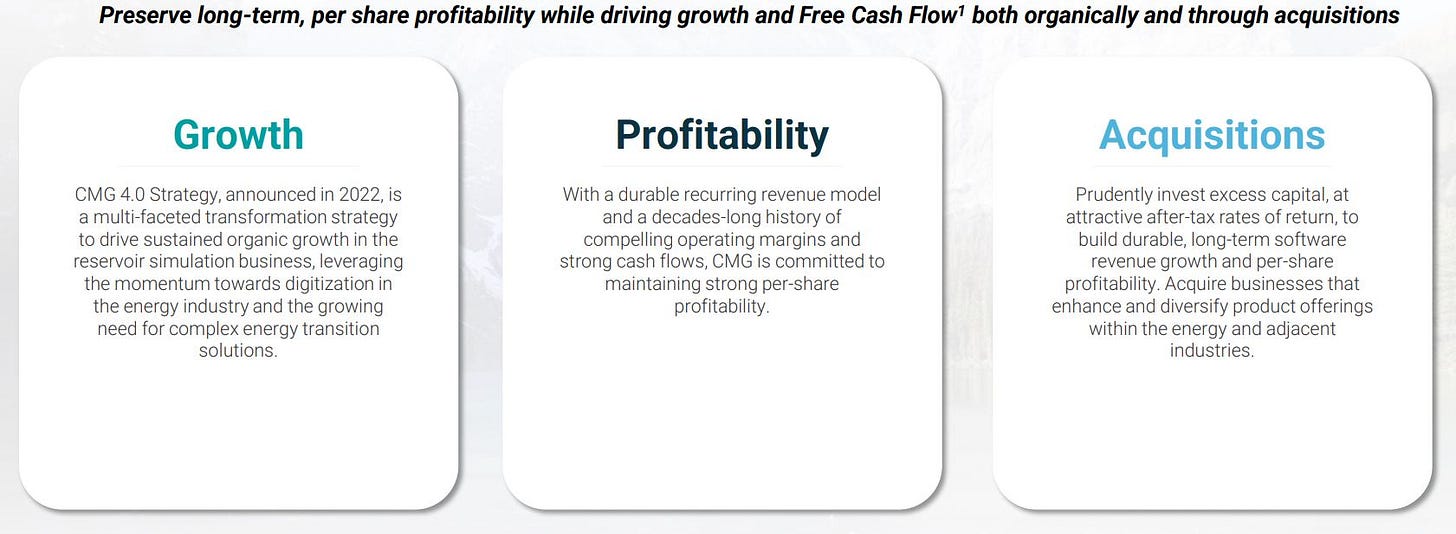

Despite being up 2,500% over its lifetime, the market cap still sits at only $650 million CAD. Factoring in the most recent pullback, the stock has not even budged in total return the last 10 years with a revenue CAGR of only 4.2%, getting significantly outpaced by the S&P 500. I will not dive deep into the history of the company and the reason for the underperformance, but I want to examine the investment thesis moving forward. The new strategy is what the company is calling CMG 4.0 which was a growth initiative announced in 2022 under new leadership.

There are 3 points I want to hone in on for my investment thesis:

1) Organic growth

2) M&A

3) Constellation factor.

2. Investment Thesis

#1 - Organic growth

For starters, CMG boasts a total 65% recurring revenue with impressive gross margins of 80%, which translates into a nice cash generative and sticky business model. This is an entrenched software that engineering students are learning in colleges and staying with over the course of their career. The business is far from broken as they are the category leader and fully penetrated in its chief market, but also as we mentioned earlier, revenue has not been growing at a fast pace as the oil and gas is a volatile industry. Recently, the oil exploration industry has been implementing more automation and software solutions into their processes. Over time, efficiency has greatly improved and operating costs have been reduced. CMG is very well positioned to continue assisting clients who are optimizing their production as the company possess a strong brand with years of leading experience going back to 1978.

CMG has been strategically expanding into the energy transition market, focusing on carbon capture and storage (CCS). As the CCS industry continues to widen, driven by government incentives and a global push for net carbon neutrality, CMG is focused on capitalizing on this exciting new opportunity and strong future growth is expected here. With its core competencies and expertise firmly in place, CCS should be able to boost total revenue, projecting a solid double digit increase.

CMG is also focusing on new energy solutions, assisting companies store carbon underground or discover places for geothermal energy. This shows adaptation to changes in the energy industry. In FY 24, 23% of CMG operating segment software revenues were related to energy transition simulation projects. I would expect this number to continue to climb in the future, which will further growth and diversification into CMG’s business model. While inorganic growth is the major focal point for this investment, there are multiple organic growth levers sill to be pulled that all seem well within CMG’s core competencies and not just some random adjacent markets. Core simulation, energy transition, and CoFlow are all areas where CMG is positioned to see organic growth with CoFlow adoption being the area where I am keeping my eye on the closest as it drives immediate 5%-7% oil production increase when implemented.

#2 - Acquisitions

Since Jain took over as CEO, CMG has performed two acquisitions as it has been in the process of building out its M&A muscle. Their financial hurdle rate is a stated 20% IRR after tax so these are highly accretive acquisitions as they do not model in synergies and will remain very disciplined for what they actually acquire. The two acquisitions to date are as follows:

9/25/23 - CMG.TO announced the acquisition (the “Acquisition”) of Bluware-Headwave Ventures Inc. (“Bluware”), a software and services company specializing in cloud and interactive deep learning solutions for subsurface decision-making including seismic interpretation. In the most recently completed fiscal year, Bluware reported total revenue of US$23.5 million (US$17.7 million from services and US$5.8 million from software) and an estimated Adjusted EBITDA margin of 5%. Total consideration paid by CMG for the Acquisition is US$22 million. In addition, there is a potential earn out provision of up to US$8 million if certain revenue thresholds related to key contracts of Bluware are met during the 18-month period after closing.

11/12/24 - CMG is pleased to announce the acquisition by a wholly-owned subsidiary of CMG of all of the shares of Sharp Reflections GmbH (“Sharp”), a seismic processing and interpretation platform for geophysicists and quantitative interpreters. In the twelve months ended July 31, 2024, Sharp had unaudited revenue of approximately €10.0 million (approximately $14.7 million), comprised of approximately €6.9 million (approximately $10.1 million) in software revenue (over 95% considered recurring software revenue) and €3.1 million (approximately $4.6 million) in services revenue. The company generated low double-digit adjusted EBITDA margin. Total consideration paid by CMG for Sharp Reflections was €25.0 million (approximately $37.0 million), cash consideration, subject to post-closing adjustments, plus an amount equivalent to Sharp’s cash on hand immediately prior to closing. CMG funded the consideration from its existing cash-on-hand resources.

The CEO commented on this acquisition detailing all the reasons and benefits over why Sharp was the right acquisition for CMG. The key to watch will be to expand these margins from say 5% to 30% or even 40% by implementing more software services. CMG has a strong balance sheet and generates nice free cash flow which will be the primary source used to fuel acquisitions, but they have also been evaluating credit facilities to use leverage opportunistically as they are confident that there are many strong opportunities that align with their IRR hurdle rate and vision.

Most importantly, I want to reassure our shareholders that I believe in maintaining a strong balance sheet and that financial leverage should be used carefully and opportunistically to enhance shareholder value without taking on undue risk.

Below is an excerpt from the most recent CEO Letter from their interim 2025 Q3 results recently published.

Acquisitions are where compounding will have the greatest impact on CMG. To date, we have bought two high quality businesses with a slightly heavier focus on services revenue and that are in the early stages of software growth. As we adjust the focus to recurring software revenue and expanding the margins, we expect to start growing our free cash flow which can be redeployed into further acquisitions.

This is a long-term, multi-year strategy. It will take time to demonstrate the evolution of the businesses and the growth in free cash flow per share and to successfully identify the right opportunities to reinvest our capital.

We have built a strong team around M&A and have expanded roles covering business development, strategy, research, and integration. Our first two significant acquisitions were complex, allowing us to start to develop an integration and M&A playbook that will set us up for further acquisitions. The size and pace of our acquisitions will continue to be dictated by the opportunities available and we are leveraging the learnings and successes of the last two years to guide further refinements to our strategy.

“Acquisitions are where compounding will have the greatest impact on CMG.” This, is what I am closely paying attention to moving forward. They have made one per year the last two years. Expect this to ramp up, but exactly how much? One thing I know is that their acquisition approach will be extremely patient and disciplined (see below), but I do expect results to show up in a meaningful way here. As eloquently as the CEO letters are each quarter, and the focus seems to be crystal clear in growing free cash flow per share, there needs to be results. Jain has talked the talk, now it is time to walk the walk.

The software applications market consisting of global oil, gas, and chemicals companies is highly fragmented and comprised of smaller vendors. They are tracking about 800 opportunities, and are seriously considering 200 M&A opportunities in this highly fragmented space that span from all over the globe. There is a large addressable opportunity here for CMG to continue expanding its product offerings through strategic and accretive acquisitions of underutilized product offerings of niche companies. If the company were to potentially announce a change to their dividend policy (currently a 2.5% yield), reduce or eliminate, I would consider this extremely bullish as it would be indicative that M&A is about to pick up heavily (Chris Mayer heavily hinted this could happen in his interview above).

#3 - Constellation - Sidecar Factor

Sidecar investing is phenomenal. With the simple click of a button, you have the opportunity to participate in the collective value and wealth created by extraordinary people (much smarter than myself) solving incredibly complex problems. One thing to get out of the way is CMG is not next the Constellation Software, Inc. (“CSI”). This is a sleepy software technology company that dominates its industry and has the opportunity to utilize acquisitions in a fragmented market to help pour some fuel in the growth engine which has largely stalled out the past decade. ROIC has been moving in the wrong direction, however, there has been a recent strategic realignment and our job as investors is to look into the future (ROIIC) not so much focus on the past.

Mark Miller joined CMG’s board back in 2019, but recently became chairman in 2022. He is the Director and COO of CSI as well as Chairman of Volaris Group and CEO of Trapeze Group. I would consider him the #2 at CSI only behind the head honcho Mark Leonard himself. Miller deeply knows how to run the acquisition playbook as well as anyone, and this is expected to be a major driver of the CMG 4.0 strategy.

Following Miller’s elevation to Chair, in late 2022 Pramod Jain was elected as CEO seemingly at Miller’s choosing. As evidenced by the snippet of Jain’s quarterly letter above, he speaks in the same long term language as Constellation does and aligns values all around. Speaking in language that is obsessively focused on free cash flow per share is music to my ears. This growth vision measured with a disciplined approach leads to high hurdle rates and long term focused M&A, not diluting share count, and enhanced focus on long term profitability. Jain's management incentives, tied to return on invested capital and growth, align the interests of insiders with those of all shareholders. The more I understand investing, I cannot overstate the critical importance of aligning management’s incentives with that of quality shareholders.

EdgePoint, a significant shareholder holds roughly one-third of CMG and brings heavy insider ownership, is managed by Andrew Pastor, who also is a CSI board member. Mohammad Khalaf was appointed as the new Head of Corporate Development in 2022. He spent 7 years at Harris Computer, an operating company of CSI, and is familiar with the CSI playbook. Also, John Billowits was on the Board of Directors in 2021 and is also on the board of CSI. John recently stepped away, but helped establish their M&A process and strategy. You get the point, not to say that the companies and industries are exactly alike because there are a lot of differences, but there is a heavy, heavy CSI influence and flavor going on here. The collective presence of these experienced individuals from Constellation Software's board, along with their substantial shareholdings, does not guarantee success, but it does indicate a strong alignment for future growth.

Everything CSI touches seems to turn to gold. CSI itself is up 300% in the last 5 years with a total return of 37,283.80% as of today’s date (yes, that is not a typo). Due to the lack of direct investment, the market is simply not betting that the Constellation playbook will be run effectively at CMG. This is a good risk-adjusted bet that I am willing to make as the redeployment of capital runway is large and the right people are in place.

3. Financial Snapshot

Fortified balance sheet:

Net cash position

Finally deploying capital

Low goodwill - Goodwill / Total assets: 2.7%

Low stock based comp - 2.6%

*Switched to CSI’s model where cash is allocated toward the equity portion of the bonus will be used to purchase CMG shares on the open market on the employee's behalf and then held for the next 3 years, which has proved to be an incredibly productive model. The gold standard in incentive structure.

Capital-light business model

Capex / Sales: 0.6%

R&D / Revenue: 23.1%

Strong cash flow conversion

Expect majority of free cash flow generated to be used toward acquisitions

Margins

Gross Margin - 80.3%

Profit margin - 19.18%

Net Promoter Score - 68% (B2B software average of 41%)

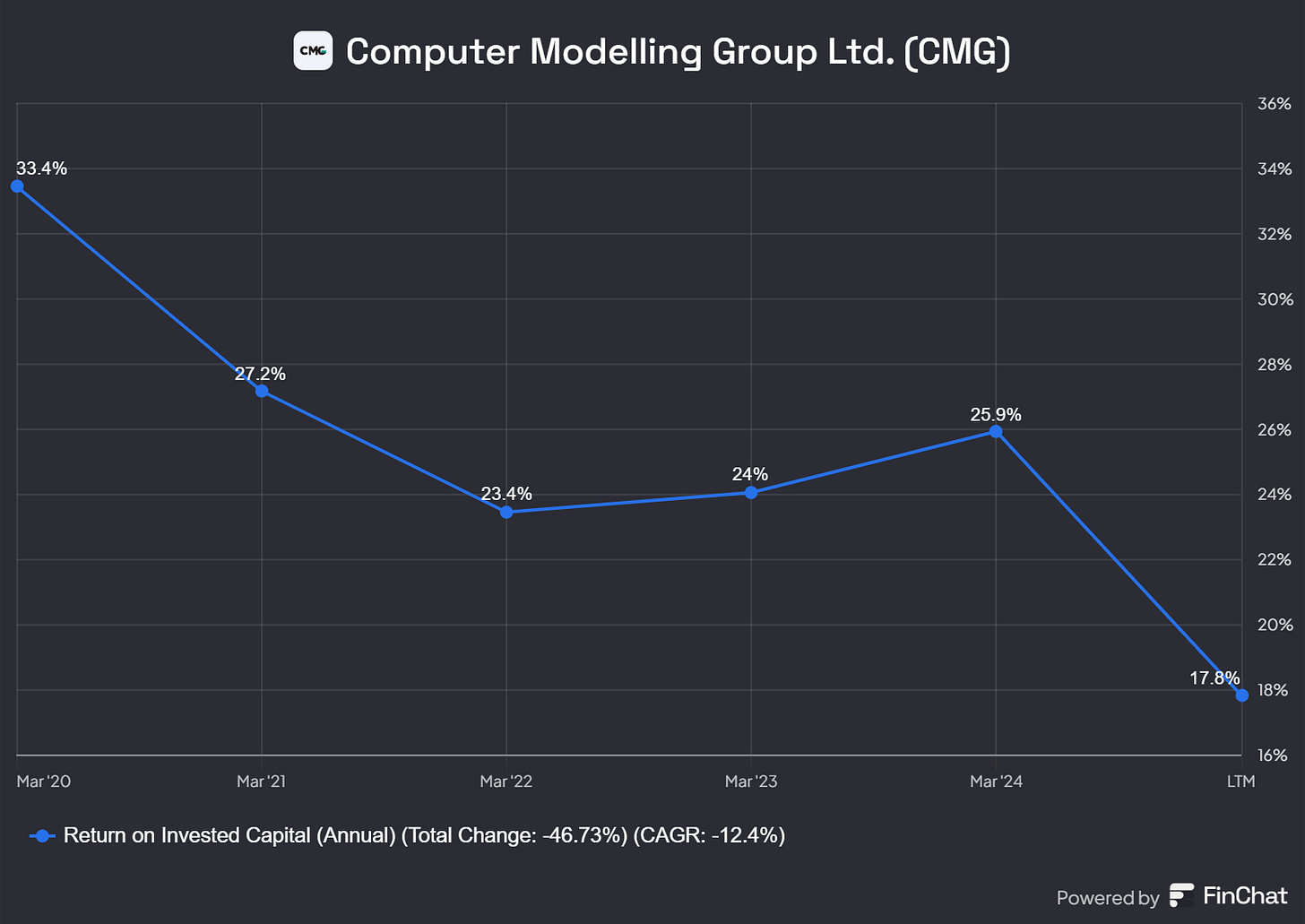

Return on invested capital has been steadily declining, which is scary. This is a historically based metric, but one to keep an eye on as it needs to, and has the ability, to inflect positively in order for this to be a successful investment. ROIIC will be key to monitor as it will show whether the organic and inorganic growth initiatives are indeed paying off.

4. Valuation

My aim here is to be directionally correct, comfortable with the assumptions I am making, and looking at a probability weighted future return.

Forward Earnings Yield: 5.15%

Forward FCF Yield: 6.32%

10 Year Treasury Yield: 4.289%

is an excellent substack that is well worth the follow (see bottom for link). I found his deep dive to be very informative and helpful in laying out the investment thesis for the company. Below is his reverse DCF model he publicly shared for what the market is pricing in. His valuation model along with my own appears to present a margin of safety at today’s levels as the market is factoring very minimal growth. Compare this valuation to some tech companies where growth of >30% is required along with no multiple contraction just to sustain current valuation levels. The price today ($7.32 at time of writing) is essentially not factoring in any growth let alone that the new CMG 4.0 strategy yields above historical returns for the company. These are the type of low risk, asymmetric bets that we should prefer to make.

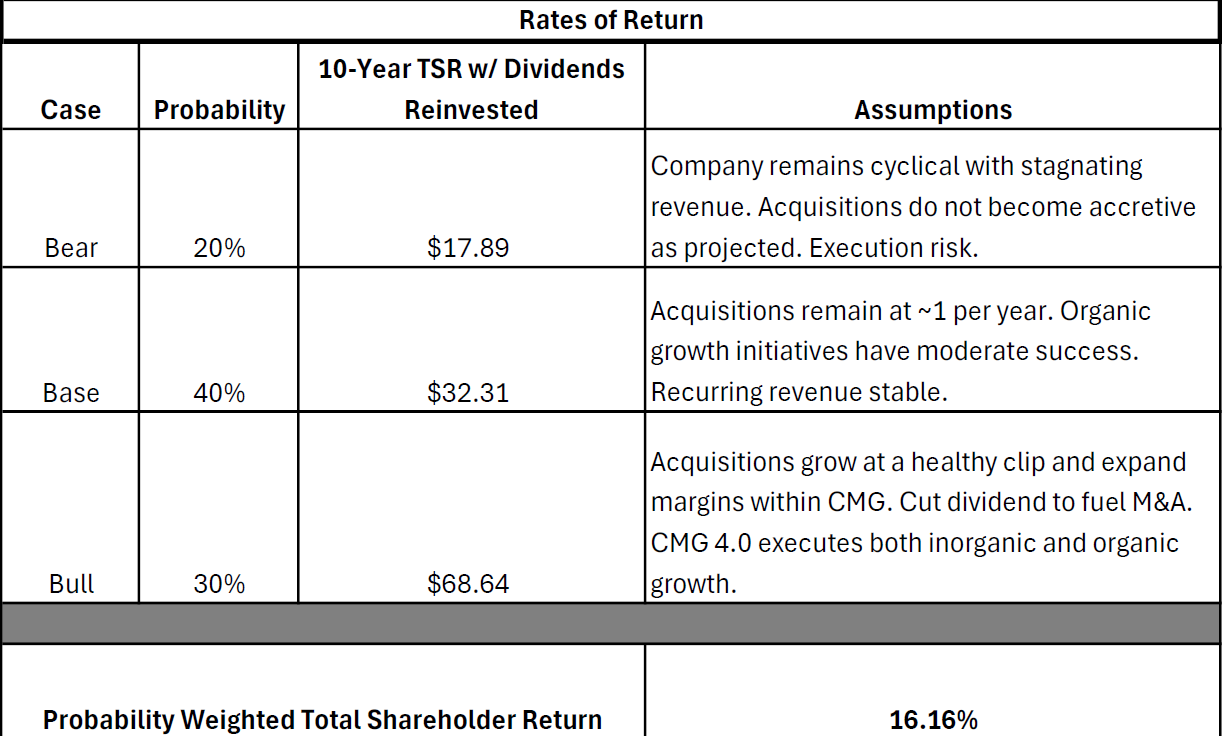

Below is my broad strokes I come up with when thinking through the probability weighted return. The downside risk is relatively low in the bear case considering the current dividend yield and starting valuation multiple. I am probably too conservative on the bull case, but it is hard to model the size and rate of acquisitions and how that will impact future margins. They have a 20%+ IRR hurdle rate so I would assume that if the acquisitions come in they will be immediately accretive. I could have even probably created a 10% “Extreme Bull” case where M&A executes better than anyone expects, but I patiently expect these to be smaller and come in slowly.

The fundamental return consisting of the dividend yield (unless they cut this to fuel M&A, which I would prefer) as well as earnings growth (reinvestment rate X cash on cash returns) presents a currently attractive potential total shareholder return.

5. Outlook

Overall, CMG is not a turnaround story, however, it is a transformation story. This story has been building beneath the surface for a couple of years, but the market is certainly in “prove it to me” mode. I am becoming more comfortable over making an investment different from the crowd as long as the underlying evidence supports it. Currently, CMG’s stock is almost in a 50% drawdown as the market is focused entirely on its slowing revenue growth. While certainly the lack of innovation has been a major headwind, the core leadership looks to now be fully intact, and the bet is that the wheels are turning with the results not fully showing up quite yet, but untapped value is on the way of being delivered. The core business is highly profitable and sticky, the incentive structure is now all aligned, expertise firmly in place, brand is rock solid, and the acquisition landscape is plentiful.

Acquisitions will hopefully start coming through and will be sized appropriately (not overly bulky but needle movers), and as eloquently as Jain writes, execution and results will need to be what is closely monitored, not articulate CEO letters. My north stars to watch are the pace/size of acquisitions, progress in organic growth initiatives, and ultimately ROIIC to inflect upwards with growth in free cash per share the key metric. I would love some commentary or confirmation that margins in the acquisitions are expanding and tucking in nicely. I reiterate this is not Constellation 2.0, however, there are similar disciplined traits that could establish a strong platform of acquisitive growth going forward. There is a lot of downside protection built in at current valuation levels, but we will have to wait and see if CMG 4.0 strategy can indeed be executed.

In summary, this is a compelling sidecar set up – aligned incentives, experienced leadership led by the Mark Miller as Chair of the Board, a healthy balance sheet with strong free cash flow generation ready to fuel M&A along with careful leverage, high returns on capital that will hopefully inflect up, 200 serious acquisition targets in a fragmented space to reinvest their capital with extremely disciplined hurdle rates, and a very, very reasonable starting valuation to boot.

Happy Compounding,

Poor Charlie

Dear Poor Charlie,

thank you for the write up!

I'm also a shareholder of CMG.

1. In the Q3/25 CMG did delete the target for low dd rev. growth. In Q2/25 and before this was the target and written down in the reports. What is your oppinion on that?

2. Are you also confused that for adj EBITDA calc they exclude sbc. In my view this is critical because they increase adj. EBITDA margins this way. One metric they want to achieve is adj. EBITDA margin of 40% or more...

3. Have you studied the management information circular (proxy statement from canada): https://www.sedarplus.ca/csa-party/viewInstance/resource.html?node=W2806&drmKey=d468f870042e2b36&drr=ss4fbef1a03d1a643c7d2c7e519738a4f59082681ddd9c1a5df1283f68266b50eda0534f369c891ed9184ae1e4accab34dux&id=0c11f8b7998bcd965161a37698dbeeb3b26bcb216aca3e80

My understanding is that all the "old" incentives compensation plans PSU & RSU Plan; International Employees PSU & RSU Plan; Stock Option Plan; SARs Plan.will be gone soon.

Only Annual Incentive Plan, CMG Bonus Matrix as well as Corporate Bonus Matrix will be aplicable in the future, What do you think about that?

I'm looking foreward for your feedback and than you very much again.

Kind Regards,

Oleg

Thanks for referencing my investment memo in your post and linking to it! One thing I would tweak slightly for wording, is the reverse DCF model I shared is my estimate of what the market is pricing in, but it's not my valuation model. My actual valuation model for what I think the business is worth based on the unit economics is in my investment memo. Great post and good luck with this portfolio holding!