Most of my posts have been more investing philosophical in nature to date, but I want to mix in more business and valuation updates as this allows me to block out the noise and clarify my own thinking about the business. This was really helpful for me and I received a lot of positive feedback for my post on Evolution EVO 0.00%↑ (which continues to draw down!). I discussed the risks, both short term and long term, and also the true risk maybe not seen, that the company has been facing as of late (this one has been a rocky ride to hold so writing helps). This post I want to run through my thoughts on Teqnion AB (publ) as this is another one of my core holdings that has been struggling mightily year to date, which is especially painful when so many other stocks have skyrocketed in 2024. I am an investor for the long term so I am only concerned with total shareholder return and will accept short term volatility and even underperformance at times, albeit reluctantly.

“The necessary condition for the existence of bargains is that perception has to be considerably worse that reality.” - Howard Marks in “The Most Important Thing”

With Teqnion specifically, is the perception worse than reality? Here is what I am trying to sort out with the stock price underperformance:

How much is due to the business fundamentals compared to short term headwinds?

How much is due to US stock market outperformance compared to Europe underperformance?

What is management saying and doing about the problems?

How much does valuation play a role? Mean reverting or an overcorrection presenting an opportunity to add?

What is the outlook moving forward in operating markets and industries?

Background

A quick primer: Teqnion is a Swedish industrial company group founded in 2006. They run a decentralized business model and specialize in profitable niche companies, currently Swedish and UK based, operating in a wide range of industries. Teqnion's strategy is based on active ownership, optimization of subsidiaries' operations, and growth through acquisitions. The types of businesses that Teqnion owns are far too many to list, but here are some: selling instruments and consumables for clinical laboratories, folding electric wheelchairs, surge protection/lightning protection, hydraulic components. In addition, the company produces customer-specific building components and specializes in contract manufacturing business. Further, it engages in the refrigerator renovation, chip-cutting metalworking, and printing operations. Additionally, the company repairs industrial gas turbines, sells stainless steel products to professional kitchens, develops equipment for military exercise firing, turnkey solutions for protective vehicles; and supplies weighing scales. They recently acquired UKLM, a lanyard company. I think you get the point, boring is beautiful.

Teqnion acquires and manages profitable niche industrial companies. These businesses operate in various sectors like defense, construction, datacenter design, electrification, and measurement equipment. By allowing subsidiaries to operate independently and focusing on high-margin sectors, Teqnion ensures steady growth and strong profit margins. The company's decentralized model fosters innovation and efficiency, contributing to its robust revenue stream. Teqnion's strategy is simplified investing in acquiring profitable, easy to understand business-to-business companies within specialized markets with high regulation barriers to entry. Similar to Berkshire Hathaway, this decentralized approach empowers subsidiaries by granting them autonomy while also ensuring they remain agile and effective. This model, combined with Teqnion's reputation for transparency and long-term support, attracts high-quality acquisition targets and creates significant barriers for new entrants into these smaller niche markets.

So going back to the original questions, what has been the cause of the recent underperformance? The one thing I appreciate the most is the straightforward honesty from the management team. Here is a quote from Johan Steene, CEO, from the recent Q3 2024 report where he clearly identifies the problem, acknowledges management’s culpability, and vows to fix it moving forward.

“Teqnion Group is fighting on in a tough environment with sales increasing 12% but organically it's only up 2%. EBITA margin decreased to 10,9% (11,7%). The profit for the quarter is down by 8% and the earnings per share is down by 10%. Sad and bad! We're selling more but earning less. Frustrating in the moment but we'll push through. There is so much potential here that needs to be capitalized. This too shall pass. Of that we will ensure.”

How much of the problem is due to the business fundamentals compared to short term headwinds?

The industrial market in Sweden is of course highly cyclical and has been in a weakened state the past few years. This has dragged majorly on Teqnion’s overall performance as the companies operating in this industry have actually been losing money and EBITA margin has contracted from 11.7% to 10.9% from YoY Q3 2024. The quick synopsis is that the companies Teqnion originally acquired to help get its start were of the cheaper variety with lesser quality and highly susceptible to market cycles. This makes sense because the company started organically and could only acquire what they could afford, which led to cheaper, lesser quality businesses. Rising inflation and rapidly increasing interest rates have weighed heavily on these companies, however, their overall effect should become less meaningful over time as Teqnion acquires more diversified sets of businesses that are hopefully more cycle insensitive.

Management is very honest in their assessment of the issues and have reiterated that they are working diligently through implementing changes throughout to help improve processes moving forward. In short, they were far too exposed to the Swedish construction sector (furniture, design architect, wooden construction, etc.) and are now working behind to dig out of the depressed cycle. CEO Johan has spoken about how they were not proactive enough in raising prices ahead of the interest rate hikes and coasted operationally in the high cycle. The overall downturn issue gets addressed by every recent quarterly letter and interim report, and management has been working hard to address, however, this has definitely been a major headwind. This is by no means a thesis breaker, but a lesson that is hopefully learned by management and applied going forward. While this is more than short term noise, hopefully, results will begin to turnaround in 2025 and management can continue to allocate capital to higher quality companies with stronger fundamentals that are far less macro dependent.

How much is due to US stock market outperformance compared to European underperformance?

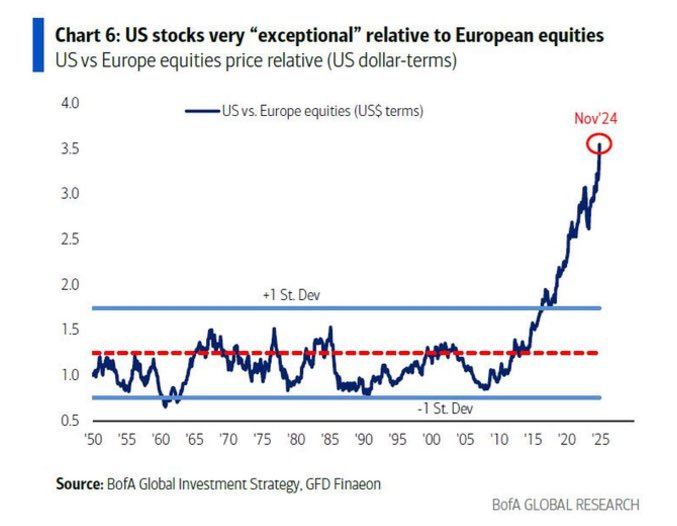

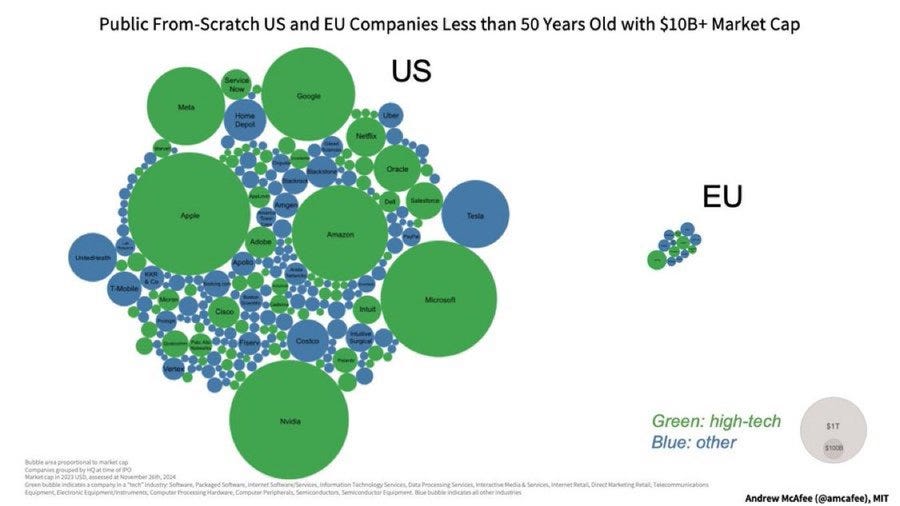

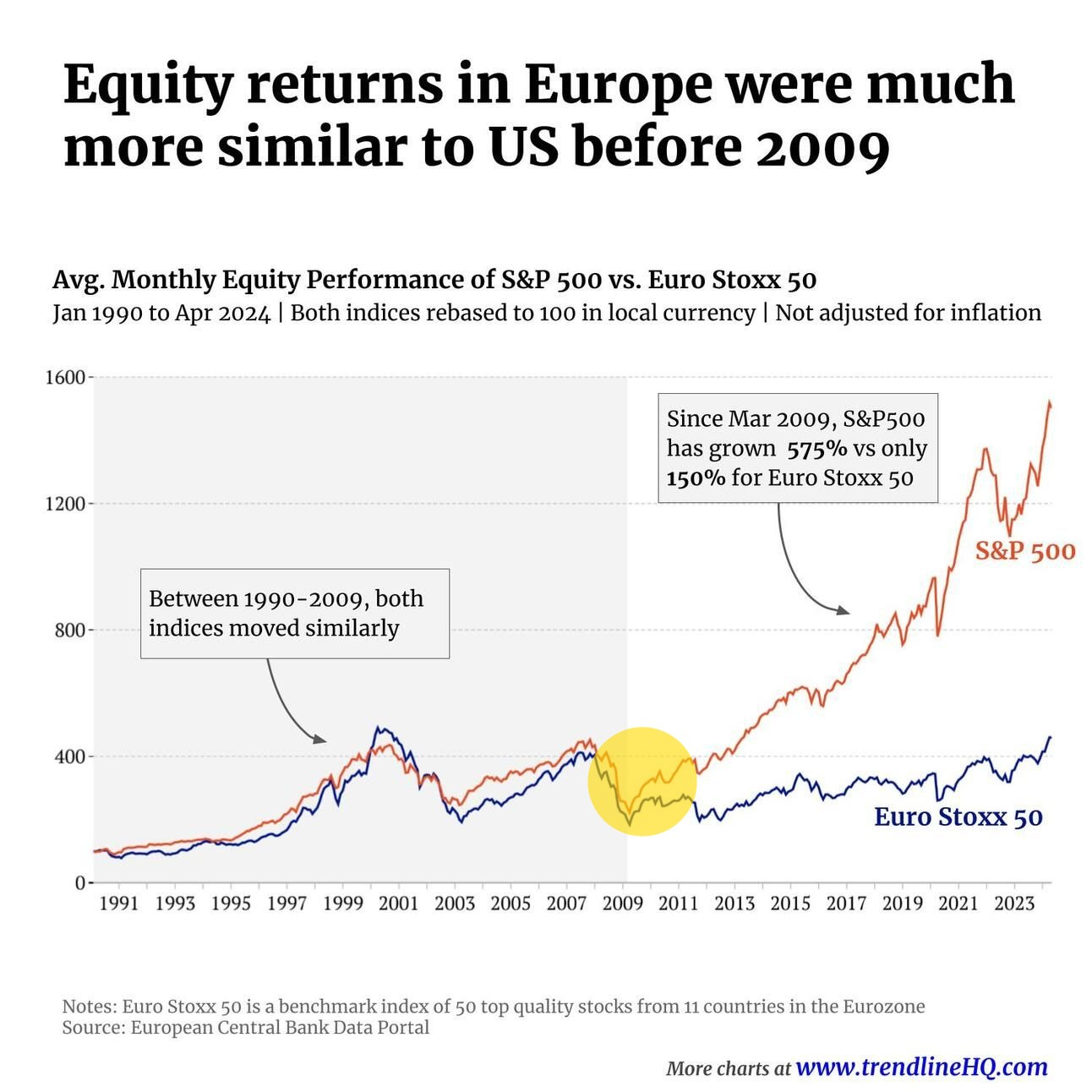

This is the least important question of the set, but one I find to be continually interesting. I am certainly not trying to bake too much macro into my analysis, but as Charlie Munger said “Fish where the fish are.” Europe’s stock market is lagging behind the US by the most in nearly 30 years. This has been completely deserved as US companies have greatly outgrown their earnings compared to European companies as tech has greatly propelled the S&P 500.

There are numerous reasons for this and I certainly want to avoid all things political, but this has not always been the case historically and believe it or not, the European stock market has even outperformed the US for brief periods. I am a big believer in the US market and economy, but I have to believe that this performance will mean revert at some point, which would provide favorable tailwinds to European companies and other non-US markets in general. Teqnion’s problems have mostly been Teqnion related, but broadly speaking at the moment, I see very favorable current valuations from certain European companies. The stock market is a momentum voting machine in the short term, but fundamentals always weigh out in the end. How or when, only time will tell. My sense is that certain European companies have been punished, perhaps unfairly, and that certain US companies (cough cough, AI) have been optimistically rewarded without being fully justified. Just something to keep an eye on…

What is management saying or doing?

I find the all around transparency of Teqnion’s management team to be very refreshing and one of the key benefits of calling myself a shareholder. There is not the usual corporate speak or jargon, but the unusual messaging style speaks directly to a commonplace investor like myself. This communication style will certainly not be for everybody, but it resonates with me personally. We are all on a journey, partnered together, there will be good times and tough times, but there is learning, growing, and trusting to create long term value for all stakeholders. This is a great confidence builder when investing in owner-founder led businesses as they speak of their business in a overwhelmingly familial tone with a highly vested interest in the long term durability and growth of the business. Teqnion is a great example of that.

TEQ 2024 Q2 “Teqnion continues to grind on in weaker markets. EPS landed on 2,01 sek for the quarter and is down 1% compared to last year. Profit after taxes ended at 4,5M sek (+5%), while net sales got to 399,7M sek (+4%). Organically, net sales decreased by 6%. These are numbers we are not happy with. We need to improve, and we will.”

The acquisitions we've made over the past few years are of companies that are less sensitive to economic fluctuations. We look for small, customer-oriented companies with their own brands operating in niche industrial sectors, preferably with complex regulations and standards to meet. These firms value their deep customer relationships and the importance of always striving to deliver genuine customer value. The companies we acquire should be able to return our investment in free cash flow within five years. We are constantly looking for new gems. The acquisition hunt is a fun adventure.

One of the highlights of Teqnion’s decentralized business model is that it empowers the subsidiaries as they still have the feeling of ownership and autonomy. This approach can work great as it enables individual companies to make faster and more effective decisions in order to strengthen their competitive advantage. This frees up management to focus on capital allocation decisions, and also subsidiaries to do what they do best, which is operate the business at a high level. However, this model relies on trust and it only works when you buy high quality, durable companies. Decentralized is a great model when operating business are humming, but has drawbacks when there are problems building up that are not being addressed timely, which has certainly been happening with Teqnion’s Swedish cyclical housing businesses.

Similar to Todd Combs at Berkshire Hathaway, who has jumped in to run a struggling GEICO business, that is probably not what he does best as he is a hedge fund manager, but he now feels his time is best suited to turn certain elements of that business around. Teqnion is now being faced with a similar question: How much direct oversight with “CEO-coaches” needs to be provided to subsidiaries in order to drive efficiency and how much is too much oversight where subsidiaries start to lose their autonomy and ultimately trust in leadership?

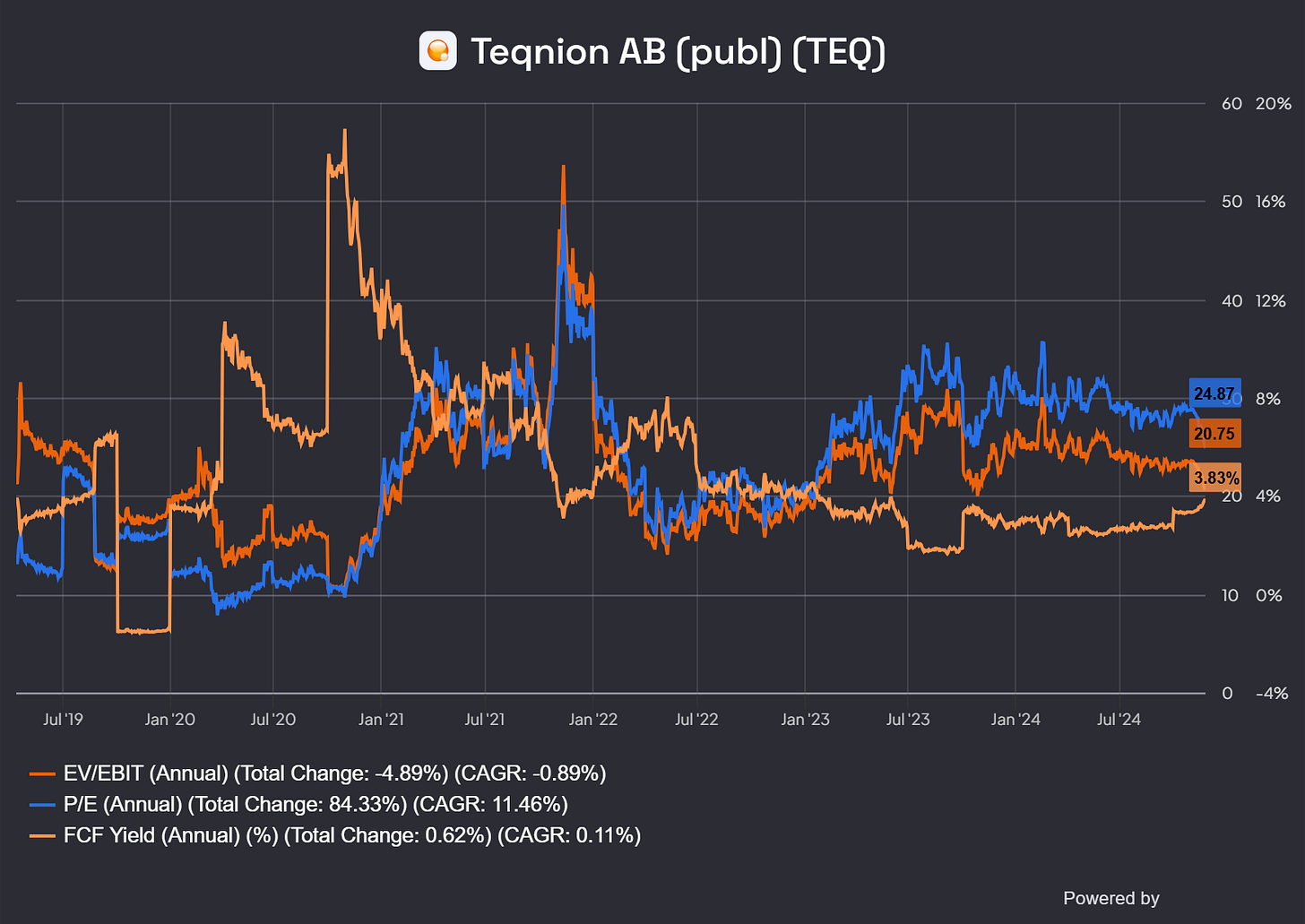

How much does valuation play a role? Mean reverting or an overcorrection presenting an opportunity to add?

Currently, Teqnion is in a 37.5% drawdown, ouch. The stock did drawdown 50% in 2022. However, a deep drawdown does not necessarily make a stock cheap as the business has suffered. I do see the valuation today as a fair price for a good company with a very long runway. As an investor, I love to focus on numbers and valuation as much as anyone else, but the fundamental question is not really one of valuation, but of business quality and performance. Teqnion only went to the public markets in April 2019 and has been heavily overexposed to cyclical Swedish industrial companies of lesser quality. This has damaged recent business performance as nearly 1/3 of cyclical companies are actually losing money. Roughly half of the profits from the last quarter came from foreign companies (UK), even though they account for less than a quarter of subsidiaries. As consistently reiterated by management, recent quarters have not met expectations, but there does seem to be a lot learned from this recent rough patch and actual strategic realignment taking shape in the meantime. This is also a good trend that recently acquired companies are or higher quality and have the ability to grow their free cash flow despite the macro environment.

An EV/EBIT of 20 (in a depressed cycle) appears to be a fair price for a company that has shown promise and current going through a temporary rough patch. Back in 2023, Chris Mayer (Woodlock House Family Capital), who now sits on the Board, along with other investors bought in a directed share issuance of with a price per share of 202 SEK. Well the price is even more discounted at 165 SEK (as I write this). The question is do you believe that the company will overcome the short term headwinds, realign cyclical weakness, and continue to acquire great companies at low valuations of less than ~5 times gross profit? At still only a $250 million market cap, there is plenty of room to run with a high reinvestment rate as long as the acquisition machine remains flowing and disciplined. Teqnion is a bit slower and more deliberate in their acquisition process, averaging ~3 business acquisitions per year.

By not utilizing excessive leverage, Teqnion remains well positioned to grow via acquisitions well into the future. I would love to see them materially improve their EBITA margin over their stated 9% goal (I am eyeing 12%-15%) by unlocking some operating leverage. The struggling business units should hopefully turn around soon to help the company remain on track of doubling EPS every 5 years (14.4% CAGR). Hopefully, this is the floor and they can even exceed expectations as valuable lessons from recent underperformance has been learned and improvements implemented. I do not expect this business to be a meteoric riser by any means, but I see it more as a slow and steady compounding tortoise that eventually wins the race. The operating businesses will become more and more durable while still generating meaningful cash flow. Collectively, these businesses are well diversified with the ability to compound earnings for the foreseeable future.

What is the outlook moving forward in operating markets and industries?

Teqnion is becoming more and more diversified in uncorrelated industries: construction, infrastructure, MedTech, defense, electrification. I currently count 30 subsidiaries. This is not a company benefitting from AI hype, but they are also no longer deeply susceptible to wild swings in housing cycles and are working hard on acquiring more robust businesses while at the same time improving their exposed businesses they had formerly bought. The housing cycle is still elevated, but has been stabilizing as of recent. Improvement in the macro will provide a tailwind, but this is not a part of management’s long term thinking, nor my investing thesis, as they are currently building for the long term.

Teqnion currently only operates in Sweden and the UK, but the future will likely see them expanding into other geographic markets. There are plenty of opportunities to be sought and Teqnion still holds the advantage of being small and nimble enough to be able to acquire many of their potential targets. They are not limited to one particular industry or segment, so I expect the acquisition pipeline to remain large for quite some time and it really just becomes about finding the right match, which should become a more efficient process the longer CXO Daniel stays at it.

Since Teqnion focuses in industrial niche companies, my question that remains is will there always exist a degree of cyclicality in different segments as there currently is with their building and housing? Cyclicality in and of itself and is not a thesis breaker as most companies have varying degrees of cyclicality, but management has to learn how to plan and manage these industrial cycles much more effectively. I do not expect any major inflection point next year, but I do expect housing market conditions to continue to stabilize in the near term.

Hopefully, focus is renewed and operating improvements are implemented in the struggling business units while the rest of Teqnion continues to profitably chug along and more acquisitions close, which is the beauty of their diversified business model. I would say my base expectation is not that 2025 is a big bounce back year (although I certainly hope so), but that there are meaningful glimpses of tangible operating progress that starts to shine through the financial results that we as investors can place our fingers on and helps reinforce what management has been saying all throughout 2023 and 2024.

“We need to have the stamina to want to be our best even when things go smoothly, so we are resilient and stay ahead of our competitors when times are tough. Like now.” - CEO Johan Steen

In regards to trusting management as a shareholder, I have been pondering the concept of quality shareholders lately. Lawrence Cunningham wrote on this as did Philip Fisher, and Buffett truly pioneered this model with Berkshire Hathaway. I will throw in other companies like Constellation Software and Markel who have a unique set of quality shareholders who are far more likely to view themselves as part owners of the business and stay with the company even through difficult conditions. By management openly communicating in a rational and honest fashion with an incredible emphasis on the long term, Teqnion is cultivating a quality shareholder base. These quality shareholders will have higher conviction, patience, and engagement with the business which provides a diverse set of advantages to management, for example, lower future volatility in the stock price because of the belief in management’s ability to execute over the long run. Buffett called quality shareholders as those who “load up and stick around.” It is difficult to put my finger on precisely, but this is just one special dynamic I am keeping my eye on as the company improves execution and builds a lasting culture for all stakeholders.

"Companies get the shareholders they deserve." - Warren Buffett in 1979

Conclusion

In order to be a successful investor, you cannot be afraid to be a contrarian. This is certainly not easy as the animal spirit in me screams "Stay with the herd or you will perish!” Well, right now the herd is following the AI boom and companies like Palantir’s valuation are being bid up to astronomical levels. Teqnion, on the other hand, is buying lanyard, surge protection devices, and rotary air compressor companies. I would say that qualifies as contrarian. One of the most important lessons I have learned from Buffett is that in a world ever changing by the day, put your focus on the things that never change. That is what I believe Teqnion is doing by finding these unique micro-niche companies that have the durability to compound their cash flows over a very, very long period of time. Some of the best performing stocks have actually been unsexy products or industries (O’Reilly’s/Autozone, Old Dominion Freight Line, Copart, Tractor Supply, etc.), because there is less competition to enter these seemingly “boring” markets. Teqnion’s focus on profitable cash flows, no matter how they look, is what will win out in the end. Just as Johan, the CEO, is focused on the long term with his ultra marathon running (kudos to him), this is a business that you can put in your coffee can and check back in many decades later and it will still be running and growing. This perpetual ownership model allows compounding to works its wonderful magic.

“If you aren't thinking about owning a stock for 10 years, don't even think about owning it for 10 minutes. Our favorite holding period is forever.” Warren Buffett

Teqnion has high inside ownership from Daniel and Johan as well as board member Per Berggren (via Vixar AB who owns 22.62% of shares of which he owns 50% of those) and other board members (i.e., Chris Mayer as mentioned above) who all have their own skin in the game. They are truly not prioritizing quarterly results or analyst estimates, but are continually focused on finding great companies followed by operating and improving those business units for many decades to come. This is displayed in everything from their business model to their conference calls to Johan’s letters.

“We haven't been near good enough. This is a snapshot from our long journey, highlighting that we have not been sufficiently effective in our leadership, despite seeing challenges accumulate over a long period. However, the current situation also reveals great potential for improvement, we're on it and we will consider all available means to get back to where we want to be.” - Q3 2024, CEO Johan Steen

Overall, the most critical element of Teqnion to me comes to the capital allocation skills of the management team as they are a “serial acquirer” at the end of the day. Their disciplined approach to allocation thus far has been sound, but they are currently cleaning up some original lower-quality cyclical acquisitions in the housing industry. Now with Daniel Zhang fully devoted to focusing on acquisitions (see resources below) and expanding their relational network, and eventually geographic markets, the hope is that the company continues to find more beautiful and boring profitable quality businesses with high barriers to entry that can compound cash flows well into the future.

“We are religiously disciplined when it comes to capital allocation.” - CXO Daniel Zhang

Ultimately, as promising as the story sounds, the company needs to be held accountable to execute on their highest measurable goal of doubling EPS every 5 years. There will always be economical challenges and plausible excuses to throw out, but execution regardless, or lack thereof, will be what ultimately matters. Management has their own skin aligned in the game, sports a strong balance sheet, and are saying all the right words with full transparency. Now execution is paramount, growth and value need to be delivered and that is what I will be watching going forward.

For me, this is still early innings with a potential durable compounder in the making. They have the blueprint, have learned from mistakes, and are full steam ahead. The changes being implemented today along with the ongoing potential acquisition conversations being had will hopefully be what transforms Teqnion and enables it to grow its earnings long into the future. I am very excited to watch the company and its eclectic set of business continue to persevere and grow stronger.

We don’t work with forecasts or annual targets because we never want to be in a situation we will be forced to make a deal for the sake of making a deal– that creates shortermism. We prefer a time horizon of 5 years in which we want to have doubled our earnings per share. Our ambition is higher and our true time horizon is much longer. We have just left the starting line. Our journey will be long. - Q1 2024 Interim Report

Happy compounding,

Poor Charlie

PS: Feel free to comment below as I would love to know others’ thoughts on the company!

Resources

https://www.redeye.se/podcast/investing-by-the-books/829026/11-daniel-sun-zhang-an-investment-thinking-toolbox

https://www.redeye.se/video/event-presentation/888856/teqnion-ceo-johan-steene-presents-at-redeye-serial-acquirers-event-march-8-2023