Forgive the cheesy intro, but this is going to be a short post that quickly covers the YTD progress of some of my favorite serial acquirers Topicus, Teqnion, and Terravest. For whatever reason, the serial acquirer business model is one that has really resonated with my investing philosophy. There are many different flavors, but in general a serial acquirer is a company that grows primarily through repeated acquisitions of other businesses rather than relying solely on organic growth (like increasing sales, expanding into new markets, or launching new products). Serial acquirers make multiple acquisitions over time as a core part of their strategy and grow by efficient capital allocation, decentralized operations, and valuing people with a strong cohesive culture.

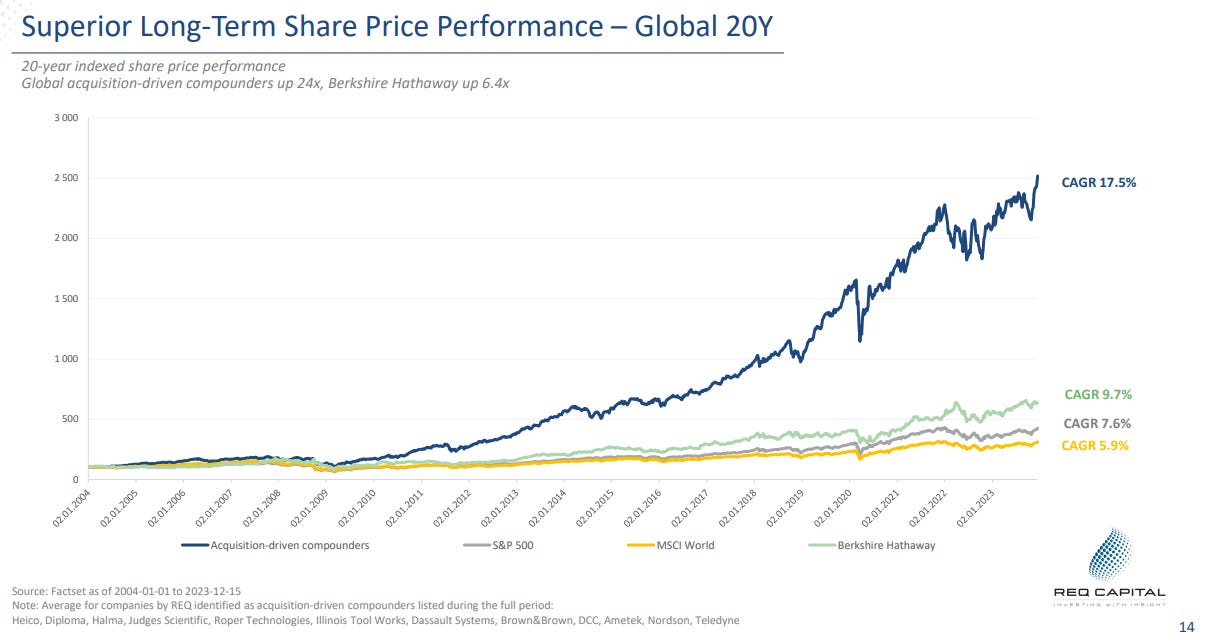

One of the main reasons I am drawn to this approach is that historically speaking, some of the biggest winners have utilized this strategy as it preserves disciplined capital allocation which is the ultimate lifeblood to a company’s long track record. Look at Berkshire Hathaway, Constellation Software, Danaher, Transdigm, and many more prime examples. Even the modern tech giants likely have some degree of acquisition success that has bolstered their core business. (Facebook buying Meta in 2012 and WhatsApp in 2014, Microsoft buying LinkedIn in 2016, Google buying YouTube in 2006), but more times than not value is actually destroyed by making acquisitions. Below is a great primer on this strategy if you are not familiar.

This business model is highly predictable due to the large addressable market of targets and having an extremely disciplined capital allocation by buying targets at very attractive price levels. While oftentimes, not the fastest moving business growth, it is a model that is highly durable, and can even present highly opportunistic deals with a patient mindset. Due to the consistent free cash flow generation and long term ownership model, when businesses become cheap, the acquisitions become more attractive, and when times are going good, well free cash flow can pay back debt or can be collected as dry powder ready to be deployed at a moment’s notice. Generally, deploying capital generates the higher IRR, however, you do not want to become overlevered so this is a delicate balance, but great management knows exactly how to manage.

With all that being said, this strategy only works in certain industries where you can buy companies cheap enough to significantly contribute to inorganic growth. If, and that’s a big if, you can allocate capital consistently in this highly disciplined manner, then organic growth is a nice-to-have rather than an absolute must-to-have. Constellation Software has been an incredible performing stock despite having low single digit organic growth. Listening to the recent Teqnion Q1 2025 call, they roughly shoot for 5% organic growth and 10% inorganic growth, on average this will lead to 15% earnings growth, which meets my personal hurdle rate as the stock will then double every 5 years if that can be achieved.

Once you understand the playbook, the business comes to life and it becomes enthralling to sit back and see what type of deals come together. Each new deal is the birth of a long term partner with very unique expertise. It could be a new vertical, or a new rolodex of potential acquisition leads, or the company may be acquisitive in its own right (as discussed further below). These may come in slowly, or they may come in bunches. The start to 2025 has been extremely exciting to watch as a few companies I follow have been off to a hot start and the acquisition and earnings flywheel is spinning rather quickly as that new free cash flow generated will be deployed into future companies and the returns on incrementally invested capital (ROIIC) will continue to churn at high rates, which ultimately rewards long term shareholders like myself.

Ultimately, Growth = Reinvestment Rate × Return on Capital, but even more important than ROIC — if you want to assess what the future returns of a company may bring — is to measure the returns on newly invested capital, answering the question how effective is the company at deploying additional capital? This is achieved with Return on Incremental Invested Capital (ROIIC). Picture the rate the snowball is increasing in size as the reinvestment rate while the length of the slope is the reinvestment runway. One observation, is that the length of runway of certain serial acquirers is severely underestimated with Constellation Software being the perfect example. Every year investors say that the reinvestment rate will slow down, yet that team continue to deploy capital at high rates of return. They operate in a particularly great industry of niche Vertical Market Software (VMS) companies, but new businesses are being created all the time and new technology and is constantly emerging, which means the pie expands, not shrinks, despite acquisitions being completed. Easier said than to actually execute, but if you have the right acquisition team and capital framework with disciplined managers, then this can be a wonderful area to deploy capital and let free cash flow compound at high rates into the foreseeable future.

How much and for how long can a company reinvest cash at high returns?

This is the central question for serial acquirers. To answer the question, being active in the pipeline and closing the right deals, at a hopefully high rate, is ultimately what we love to see an investor. Let us look into the compounding rate playing out in real time with a few of my favorite examples.

#1 - Topicus

The gold standard. This has leapt up to be my largest position and frankly speaking, I do not own nearly enough. What has attracted me so much to Topicus has been that they have found a way to achieve a ~6% organic growth rate, surpassing the Constellation mothership. This has been a tremendous surprise on the organic side, however, the acquisition rate had previously been slower moving. That all drastically changed beginning in 2025, and I would say the market is slowly recognizing this shift.

-BIG Deals-

January 14, 2025 - Topicus.com Inc. Reaches Agreement to acquire Cipal Schaubroeck in Belgium, its largest acquisition since Topicus.com BV; even slightly bigger in terms of revenues (trailing run-rate of 110 million EUR as of FY24, versus Topicus.com BV’s 101 million EUR in FY19). The target: the Belgian government software group Cipal Schaubroeck.

January 31, 2025 - Topicus.com Inc. acquires 9.99% Stake in Asseco Poland S.A. in Poland - Topicus.com Inc. (TOI.V) today announced that Topicus’ subsidiary Yukon Niebieski Kapital B.V. has purchased 8,300,029 shares in Asseco Poland S.A. from Cyfrowy Polsat S.A., representing approximately 9.99% of the issued shares in the Company. The shares were acquired at a price of 85 PLN per share.

February 3, 2025 - Topicus.com Inc. announces Shareholders’ Agreement Topicus.com Inc. (TOI.V), having previously announced on January 31, 2025 its purchase of 9.99% of the issued shares in Asseco Poland S.A. (“Company”) from Cyfrowy Polsat S.A. at a price of 85 PLN per share, today announced that its subsidiaries Yukon Niebieski Kapital B.V. (“Yukon”) and TSS Europe B.V. (“TSS”) have signed a shareholders’ agreement (the “Shareholders’ Agreement”) with the Adam Góral Family Foundation (“AG”), governing their cooperation in connection with Yukon’s and AG’s respective shareholdings in the Company. The Shareholders’ Agreement will only become effective upon the completion of Yukon’s acquisition of 12,318,863 treasury shares currently held by the Company at the proposed purchase price of 85 PLN per share, representing 14.84% of the Company’s share capital, which purchase remains subject to the execution of a purchase agreement in respect thereof, and any applicable regulatory approvals. [*Asseco Poland SA as of 4/24/25 now trades at 151 PLN per share, approaching a 100% return in less than 3 months=not too shabby IRR. Also, this shows another exciting growth lever as this was a complicated transaction for a non-controlling interest]

-Other deals-

January 6, 2025 - The Dutch software company Acto Informatisering joins Total Specific Solutions

January 7, 2025 - The German benchmarking, consulting, and software company Hachmeister + Partner has joined Total Specific Solutions DACH

January 15, 2025 - Total Specific Solutions has acquired the healthcare software companies iSOFT Nederland B.V. and ExpertDoc B.V.

January 16, 2025 - Total Specific Solutions expands into Indonesia with the acquisition of PT Realta Chakradarma

January 27, 2025 - Total Specific Solutions expands in Cyprus with the acquisition of Dot.Cy

February 6, 2025 - Sofinn, the Italian software company active in the automotive aftermarket, has joined Total Specific Solutions

February 13, 2025 - Dolist, the French email marketing software and consultancy specialist, has joined Groupe TSS in France

March 12, 2025 - The UK software company Lighting Reality Ltd. has joined Total Specific Solutions in the United Kingdom.

April 3, 2025 - The Bulgarian software company SelMatic has joined Total Specific Solutions

May 2, 2025 - The Norwegian commercial real estate property tech company has joined Total Specific Solutions

May 6, 2025 - The German Geographical Information System company INTEND Geoinformatik GmbH has joined Total Specific Solutions DACH

Do not forget about Topicus’s 72.68% ownership stake in Sygnity that it took in 2022. An average investment of 12 PLN/share, which is now up to 92 PLN/share (I have to keep updating this figure upwards ha), and represents ~4% of the total market cap for Topicus, not a bad CAGR for a ~8X return. More recently, they acquired shares in Asseco Poland at 85 PLN. Three months later, those same shares are trading at 150 PLN — a ~80% return in a quarter. Now they are at 170 PLN and have doubled in 5 months, greater than a 200% CAGR ha! These acquisitions would not meaningfully move the needle for Berkshire Hathaway, but they are absolutely meaningful for the size of Topicus, which is part of the genius spinoff strategy that CSI has implemented. Sygnity itself is growing at a great clip and also looking to acquire companies, which only increases the velocity of the compounding flywheel that Topicus is experiencing. Free cash flow is moving up and to the right!

If you think of a company even like Topicus today, given their size, still 60% of their revenues are in the Netherlands, which is a country of 17 million people, and they are continually expanding into more countries and more geographies. The runway is just massive, and it keeps expanding all the time due to the growing market in terms of the total number of vertical software companies being created. Once again, this acquisitive strategy allow Topicus to deploy capital countercyclically and only when the deal terms make sense. All of these factors lead to the stock greatly outperforming the market, with YTD performance shown below.

All hell broke loose when Topicus.com announced the payment of a special dividend of 200 million EUR on March 28, 2024 as this signaled to the market that the reinvestment was not nearly as large as investors initially estimated. However, one overarching theme with serial acquirers is that you have to fully trust management’s capital allocation skills and timing, which oftentimes means that acquisitions will not be done in a linear path, but will be done in a disciplined and opportunistic fashion. Let me repeat myself, acquisitions will not be done in a linear path and you will have to trust management’s capital allocation skills. This lumpiness will lead to the very best deal outcomes, yet will often lead to highly unpredictable patterns. As of this writing I count 16 acquisitions to date 1/3 of the year complete, but that number is likely higher by the time you are reading this.

#2 - Teqnion

Teqnion has been hurt in the recent cyclical downturn as its original acquisitions in the homebuilding business were proven to be of lower quality, hence, you get what you pay for as they were of the cheaper and smaller variety. Their more recent acquisitions have been of higher quality and are operating admirably contributing more and more to a % of overall revenue (the beauty of the model). Zooming in on 2025 YTD, they have already acquired 6 companies, double what they acquired in all of 2024, so this will already be a record year despite what happens the rest of the year.

Do not just focus in on the volume of the acquisitions, but also the profitability of these acquisitions. The newly acquired international companies have EBIT margins north of 20%, which indicates that this should be the new expectation going forward. Margins should be sustainable per management so overall the more recent acquisitions are of a much higher quality than before with the size continuing to grow as well.

“And I think that that has changed a lot. I mean, only through the four, five years I've been here, I know that before I came buying something that made roughly 5,000,000 Swedish krona (~$0.5mil), that was seen as rather big because that would be 10% of the earnings at the time. Now we don't look at things that make five. We look at things that make at least 10 (~$1mil), give or take, Swedish krona, and that will probably change over time slowly year by year.” - CEO Johan Steene, Q1 2025

This is the snowball/compounding effect. Executing disciplined M&A, running a low-cost decentralized model, maintaining the culture, steadily increasing organic revenue, reinvesting free cash flow at high rates of return.

#3 - Terravest Industries

Terravest Industries is a Canadian industrial company that manufactures and distributes equipment for the energy, agricultural, and commercial sectors across North America. Despite a seemingly dying industry, the company has also deployed a sound acquisitive playbook snapping up business with disciplined underwriting that can be rolled up to its core cash generative operating segments. CEO Dustin Haw has proven to be an exceptional leader who was drawn to mundane yet essential businesses. These operational investments deliver long duration benefits, the balance sheet can be appropriately leveraged, and competitive threats are slower moving. “Boring,” yet again, has proven to be immensely profitable.

TORONTO, ONTARIO (March 17, 2025) – TerraVest Industries Inc. (TSX: TVK) (“TerraVest”) is pleased to announce that it has acquired EnTrans International (“Entrans”) – a premier North American manufacturer of tank trailers and transportation solutions.

Terravest recent acquired EnTrans International in its largest acquisition to date. The deal was a purchase price of $US546 mil at closing plus a contingent earnings payment of up to US$46 mil based on financial performance - representing a multiple of 7.0X trailing twelve-month EBITDA. This is slightly higher than what Terravest typically pays for acquisitions, however, this seems like a great strategic acquisition and an awful lot of bang-for-your-buck. The EnTrans acquisition represents approximately 26.8% of TerraVest's current market capitalization and should be immediately accretive to earnings per share with a low CapEx and cash generative base. Entrans itself is acquisitive in nature and has a strong track record. The company was just awarded a 10-year $558M hybrid contract by the U.S. Army’s Tactical Fuel Distribution System, its largest contract to do which will provide great value going forward.

You can see above the beautiful flywheel of strategic acquisitions and just how that capital continues to get redeployed into new opportunities that will continuously compound returns. In just a six week span, Terravest closed its EnTrans acquisition (as mentioned above its largest to date), added three bolt-ons (LBT, Simplex, and Tankcon FRP) deepening the tank-trailer moat and push into standby-power infra, and raised it recurring dividend to shareholders. As investors, you love to see management just flat out execute! What a run the stock has been on as the company continue to find acquisition targets and deploy capital.

Conclusion

My investing style has been one of reducing all the noise to concentrate on 3-5 KPIs, “North Stars,” that ultimately will drive value for the business. When you deeply know the playbook of the serial acquirers and you intimately understand, then you can trust their disciplined approach in capital allocation, decentralized operations, and preservation of long term culture. Oftentimes, their addressable markets are more expansive than people realize and expanding as new technology and trends emerge. Constellation Software is the gold standard for how this is continually done as they maintain execution at a high rate of efficiency. While it may be harder to measure younger companies to this same standard, if you can execute, then this playbook has historically proven to produce very high rates of return on capital for long periods of time.

“It’s impossible to understand our business by trying to understand all the individual businesses we own…From a valuation perspective, what counts is how much capital can we deploy, at what rates of return, and what the underlying organic growth is of our businesses. Those are the key things you need to understand to decide whether this is a solid investment.” - Jamal Baksh, CFO of CSI

A stock’s long term return almost always comes back to the people allocating the capital especially with serial acquirers. As shareholders, it is simply amazing that with the push of a button, for virtually no cost, you can buy shares in Constellation Software and ride Mark Leonard’s coattails as he adeptly deploys capital in increasingly innovative manners. A very simple approach, yet one which produces astounding returns. When you fully trust management’s capital allocation as a serial acquirer, it becomes a joy to sit back and watch them work and see which new companies join the family to help increase the snowball of free cash flow.

Happy compounding,

Poor Charlie