“The big money is not in the buying and selling, but in the waiting.” — Charlie Munger

With all the recent political shocks and noise, I felt this was the perfect timing for a post on what actually matters for investors like myself: the long term. Recently, no country was left untouched in President Trump’s Liberation Day tariffs, with over 180 nations worldwide slapped with a 10% tariff. This even included the Heard and McDonald Islands, an Australian territory since 1947, located in the Indian Ocean, which is only inhabited by penguins. While I have seen this topic debated to death, I do no plan to speak on it here, but only to illustrate one point: These short term noises are ultimately irrelevant to the long term investor. The only reason I reluctantly bring tariffs up now is that they clearly demonstrate that you cannot reasonably predict what will happen in the short term nor how quickly the market will overreact. These haphazard and directionless tariff policies prove that point as they will likely be almost entirely forgotten about 5 years from now yet today they are all anyone can talk about as they stoke high degrees of uncertainty. While all the fearmongering lingers, the policies will have little to no impact on the intrinsic value of the companies within your portfolio.

The good news is that this short-termism creates all kinds of volatility and hence opportunities for true long term investors. American corporations were valued at $6 trillion less on April 8th than they were on April 2nd. On April 9th, they were valued at $4 trillion more at close than they were at noon. I am fairly certain that the present value of all future cash flows coming from American businesses did not change by 10% in mere hours. With financial news and media and algo trading, these momentum swings and volatility spikes come fast and furious nowadays. Amidst the short term chaos and uncertainty, there will always be opportunities that will present themselves to the prepared and patient long term investor who is ready to strike.

The market seemingly baits you into making a move or feeling like you need to “react” or get “defensive” or “this time is different,” but in reality these “storms” will come and go. I see certain investors posting about going to cash at 20% up to 100% in their portfolio, and all I can say is that is definitely not the game I am playing. We are all allowed to play different games, however, you should be honest with yourself over what game you are truly playing as switching in and out at the wrong time leads to detrimental results. Remember, the market does not wait! Personally, underneath the pain and uncertainty, I am looking past the noise and searching for opportunities where the short term price is now overly discounted to the present value of all future cash flows for a macro reason outside of the company’s fundamentals. Just as I always tell myself when my 1 year daughter, who is currently completely obsessed with and only wants her “Mama, mama, mama,” I am playing the long game to when one day she will actually need “Dada, dada, dada.”

“There are 60,000 economists in the U.S., many of them employed fulltime trying to forecast recessions and interest rates. If they could do it successfully twice in a row, they’d all be millionaires by now. As far as I know, most of them are still gainfully employed, which ought to tell us something.” - Peter Lynch

I am not a long term investor. I am simply an investor. There is no such thing as long term investing. The word “investing” at its core already implies a “long term” timeline. Any alternative form of “investing” that is not long term oriented, is actually not investing at all, rather this is called “trading”. I am definitely not a trader (although sometimes I erroneously behave like one). I define long term with the next 3-5 years as a starting point, and ideally investing out for decades, which will put me way further out than Wall Street’s quarterly earnings game. In this technological day and age, it seems that the market has become more short term focused as ever as business cycles tighten and the velocity of momentum, up or down, has become seismic.

Short term has always been the nature of the market as it is a product of human emotions, and we as humans never change. John Maynard Keynes connected the phrase “Animal Spirits” with finance and that human nature feels that it must take action in order to survive, which can often lead to detrimental behavior in investing. This market inefficiency unlocks an advantage for the average “long term” investor though, which is to seize upon this time arbitrage because in the long term the market is a weighing machine and will ultimately always revert back to efficiency.

“Markets will be permanently efficient when investors are permanently objective and unemotional. In other words, never.” - Howard Marks

I am not just a buy and hold for long term’s sake, but buy (right), verify, and optimize. Investing can be simple, but is seldom never easy especially not emotionally. I think about investing in a similar vein to farming. Who plants a crop and then yells at it the next week when it has not sprouted yet? Does a farmer constantly only look at the sky to see if a storm is blowing in? That is not how farming works, similarly, that is not how investing works. Trading yes, but not investing in its purest form as all investing is long term in nature. IMPORTANT: This is definitely not to say that all companies deserve to be held in perpetuity or even long term, hence the “buy right” or “buy as right as can be” and then give your investment thesis time to play out. Pay close attention to what truly matters for the business and have patience (but also not too much slack) when it comes to companies actually executing.

What does a giant hot dog and soda have to do with long term investing? Costco’s COST 0.00%↑ price of $1.50 for the hot dog-soda combo deal has remained the same price since 1985. 40 years and counting!

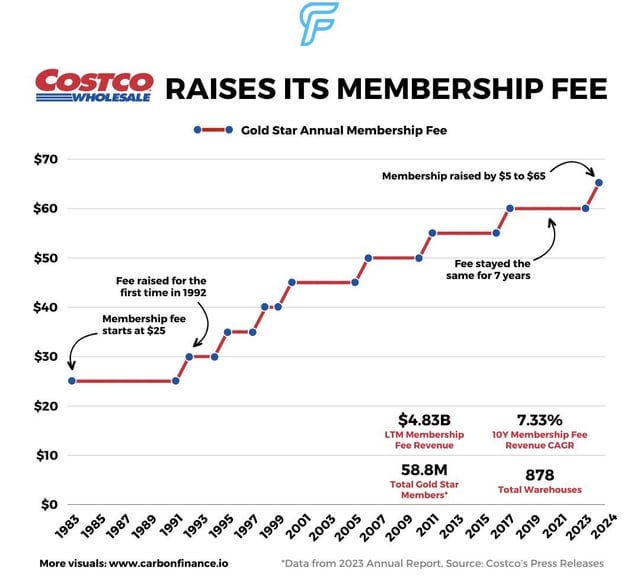

The Gold Star membership was first sold for $25 in 1983. Costco has very slowly, deliberately, raised the membership fee only a handful of times as it is primarily concentrated on creating an enormous amount of consumer surplus. During COVID-19, when almost every other company was raising prices and justifying it due to inflation, Costco was not because it places the utmost importance on creating value for its customers. The business has endeared enormous amounts of goodwill, but because it focuses on the long term quality of the business, they very slowly release this value with price increases. The company only just now raised their membership price only $5 in 2024 for the first time since 2017. This has led to an industry best membership retention rates of ~93%.

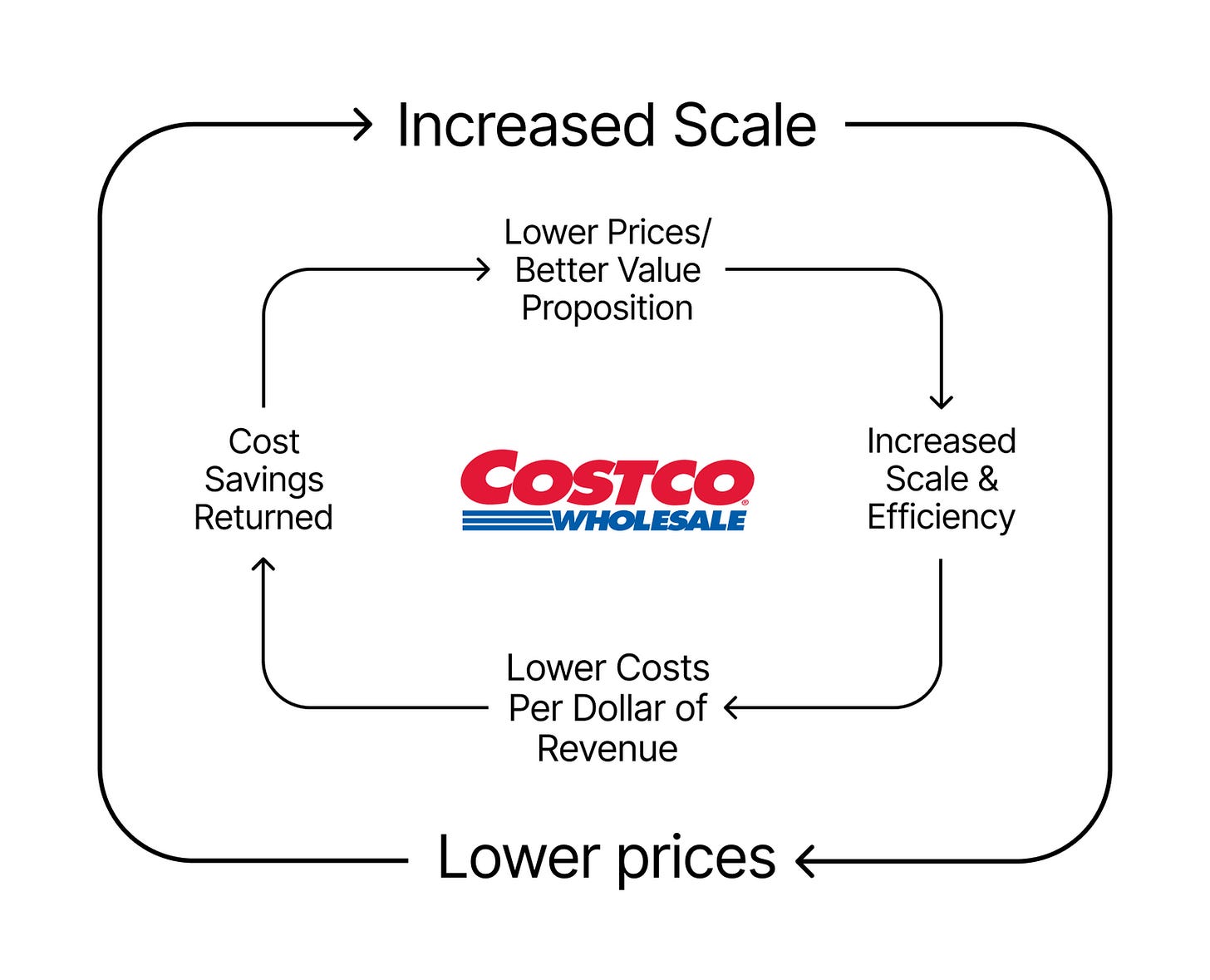

Costco’s mission statement reads "to continually provide our members with quality goods and services at the lowest possible prices." Through this “scale economies shared” model, Costco has seamlessly executed this mission over the years, creating value for the entirety of their stakeholders: employees, suppliers, customers, and shareholders. This is a company that is obsessed with cultivating long term value, preserving consumer surplus, and aligning incentives for all stakeholders, which are exactly the type of companies I am looking to invest in. Everybody wins in the long run!

Amazon AMZN 0.00%↑ is another great example of a company who excelled in building up customer value over time. If a business creates long term value, growth will follow, once growth follows, the stock price will eventually follow. Similar to Costco’s model, the value of the prime membership has always exceeded the cost. This has only been achieved by a long term approach of Amazon building out their distribution and fulfillment network amongst considerable investments. Now that Amazon is one of the world’s most valuable brands, they can slowly release that pricing power surplus over a long runway as they continue to add additional benefits every single year while slowly extracting that value and converting it to earnings.

“We're not competitor obsessed, we're customer obsessed. We start with what the customer needs and we work backwards.” - Jeff Bezos

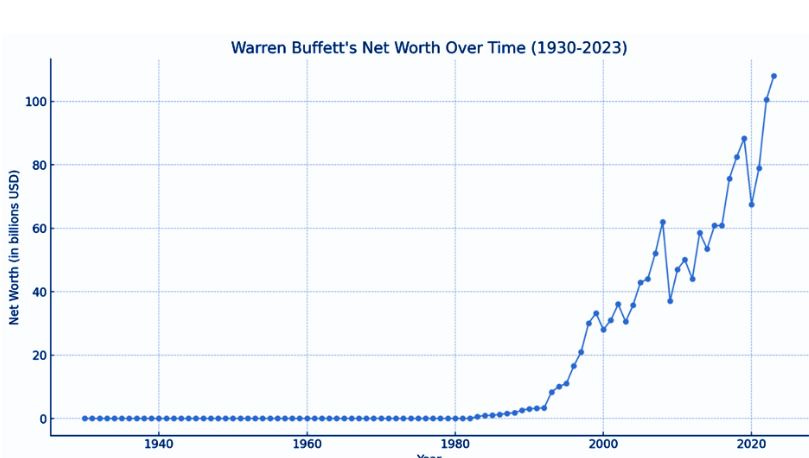

Warren Buffett, who is widely regarded as the greatest investor of all time, does not actually have the highest investment performance compared to other investors. Not even close really. What Buffett does possess is the longest track record of any investor. Investing is a long, hard game full of emotional highs and lows. Buffett has played and enjoyed that game for the last 80+ years and has made many great investments, but really his success stems from the fact that he has simply just played the game longer than anyone else has ever done.

To that point, 99% of Buffett’s net worth was accumulated after he was 65 years old. Time and compounding go hand in hand. Buffett began investing in the third grate and had already accumulated $1 million by age thirty (1960)(equivalent of $10.8 mil in today’s $). Never forget that the magic of compounding is backloaded. You are winning in the waiting, it just takes patience.

“His (Buffett) skill is investing, but his secret is time…That’s how compounding works.” - Morgan Housel in “The Psychology of Money.”

“The biggest thing about making money is time. You don’t have to be particularly smart, you just have to be patient.” - Warren Buffett in “Becoming Buffett”

“Time is the friend of the wonderful business”. - Warren Buffett

My main edge in today’s stock market comes not from trying to compete within the crowded and noisy short term arena for better or quicker information, but rather from going “over the top” of all of that noise and truly evaluating stocks as long-term ownership stakes in real businesses. In 1984, Robert Kirby published The Coffee Can Portfolio. His findings were that professional money managers do not produce higher returns compared to an unmanaged portfolio. However, Kirby did find that it was possible for skilled active managers to produce superior returns if not weighed down by high transaction costs. Here is the key: To achieve high returns, managers had to think like investors with a multi-year time horizon. In other words, active stock selection could still effectively work, but it had to be joined with a passive buy-and-hold mindset once stocks selections were made.

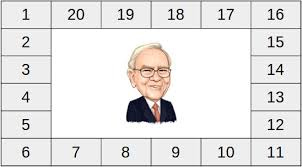

Another example is Buffett’s punch card strategy. Imagine an investor who has a 20 slot punch card, every time this investor makes an investment, he/she punches one of the holes. Given this constraint, the investor will slowly and deeply think through each selection more diligently. The punch card illustration highlights the value of a long term mindset, where an investor will be highly focused on the quality and the durability of the business. Obviously, Buffett himself has not operated within this constraint and has made many more trades than 20, but his deep focus has always been long term in nature and on the predictability of the earnings growth of the business, which is based on the forces that do not change, largely human behavior. This simplified investing approach allows for complete maximization of outcomes as you are only focused on your very best ideas and content to watch other pitches fly by.

A janitor secretly amassed an $8 million fortune and left most of it to his library and hospital

The story of Ronald Read is a great and lesser known story outside of the financial circles, but it is an amazingly sweet and simple one. Ronald Read was a Vermont-based janitor and gas station attendant who shocked his local community when they learned he had a total $8 million of savings upon his passing at the age of 92 in 2014. They learned this because he donated $4.8 million to the local hospital and $1.2 million to the local library. Read was a World War II veteran who earned a very modest paycheck, but maintained an extremely frugal lifestyle and invested steadily throughout the course of his life. Not even his family and close friends had any idea he had amassed that amount of money. He drove a used Toyota Yaris, chopped his own firewood, and even used safety pins to hold his coat together while wearing shabby flannel shirts.

The hospital knew of Read not because he was a patient receiving treatment, but because he would frequently show up to drink one cup of coffee and eat an English muffin with peanut butter (as shown below).

What was Read’s secret? It was not that he was a legendary stock picker or an amazing short term trader attuned to the political movements. No, similar to Buffett, the primary component of his success was simply that he had been investing for the majority of his life and held many of his stocks for decades. Despite being a World War II participant and working a modest job, Read still began investing early and bought his first shares in 1959. This is over half a century where compounding interest could work its magic. Consistency, frugality, and most of all TIME were Read’s allies. The Brattleboro Memorial Hospital has now named 27,000 square feet the Rodney Read Pavilion.

What a heartwarming story. Read’s legacy is not as a no-name janitor, but rather as a self-made philanthropist who generously gave back to his beloved community and has now inspired many other common people like myself. It is not what you make or how much you have, but rather what you do with it.

Compounding

"Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” - Albert Einstein

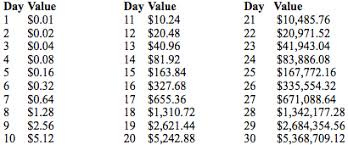

I could write an entire post on the magic of compounding as one of my favorite phases is shown above. As remarkable as an investor as Buffett is, he has needed a lot of time to allow the powers of compounding to work its magic. My favorite simple example to illustrate compounding is the basic question of “Would you rather have $1 million or a penny doubled every day for 30 days?” If you chose the $1 million, then you just made a $4,368,709.12 mistake. The concept of compounding is almost impossible to wrap the human mind around, but essentially it needs time to work. And it when it works as an investor, it works wonders, just ask papa Buffett!

“Our favorite holding period is forever.” - Warren Buffet

Conclusion

Many people will claim they are long term investors, but few will truly carry this mindset in difficult times. It sounds wise, but a lot of the times investing is like farming; boring and regimented. Naturally, I desire for the companies I invest in to provide me instant gratification, but oftentimes the market tests your resolve and forces you to wait. I have discovered that the more I focus my mindset on the long term, the more I pay attention to the key business fundamentals, which forces me to understand the company much more thoroughly. The closer I follow the company, the more I truly understand the company’s key drivers and the direction the ship is sailing no matter how violent the storm. This has also brought me more joy as an investor, as I am not overly concerned over the daily stock price or technical short term patterns, but focused on the underlying business (definitely still working on this). Investing comes to life as I discover how the business is innovating products, overcoming challenges, adapting to challenges, obsessing over customers, entering new markets, integrating acquisitions, dominating market share, executing strategy, etc. I am now thinking more as a long term business owner, which subsequently is making me a better investor.

Investing distilled down to one principle would be PATIENCE. The most powerful force in investing is not analysis, diversification, or timing, but rather TIME. In difficult and volatile times, hold fast to this timeless principle and you will be rewarded as a better investor. Said another way, “The stock market is a device to transfer money from the ‘impatient’ to the ‘patient’.”

In order to enjoy the views from the top of the mountain by way of the compounding path requires sacrifice, delayed gratification, long-term focus, and most of all, a play to fight off the foes of intermittency and variance when they rear their idle heads.

“It’s not the things you buy and sell that make you money; it’s the things you hold.” - Howard Marks

Happy compounding,

Poor Charlie

![OC] Amazon Prime membership growth over the years. : r/dataisbeautiful OC] Amazon Prime membership growth over the years. : r/dataisbeautiful](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2137ccd3-8751-4b52-844e-6ea70c8fa2b4_2400x1600.png)