Like many of you reading this, I have gained an enormous amount of insight and wisdom from reading and studying Buffett and Munger over the years. Not only have they created incredible wealth for Berkshire shareholders, they have passed down timeless investing principles and general worldly wisdom. I have read and listened to many a Berkshire content, but I thoroughly enjoyed the way Alex Morris organized the book “Buffett and Munger Unscripted: Three Decades of Investment and Business Insights from the Berkshire Hathaway Shareholder Meetings,” which covered the AGM meetings dating back to 1994 organized by subject. Next on my reading list is “The Essays of Warren Buffett” by Lawrence Cunningham and also “Buffett’s Early Investments” by Brett Gardner. Side note, my wife was shocked at how much these Kindle books cost $30-$35 (Alex was giving 1/2 of proceeds to charity). What can I say, some guys go to the bar or golf, I like to nerd out and read about Buffett’s investments in the 1950s. So let’s dive in to my top takeaways!

“You can’t look around for people to agree with you. You can’t look around for people to even know what you’re talking about. You have to think for yourself. And if you do, you’ll find things.” - Buffett, 1999

Independent thinker - The #1 trait as a successful investor is the ability to do your own research, come to your own conclusions, and develop your own conviction. It feels very safe to stay with the herd and blend in with the crowd, but this will simply not generate market beating returns and will often lead you straight off the cliff itself. The highest returns are when you find that contrarian piece of information that sets your bet aside from others. There is ear deafening noise in the markets and many differing opinions, but if you develop your own thoughtful process and maintain a balanced temperament to stay the course, then your competitive edge will be proven over the course of many years.

Performing average actions will lead to meager results. Know the game you are playing and understand that there are opportunities out there due to the fact that others are playing a much different game. My guiding light is always being long term focused rather than short term. Simple, yet so often not followed. If you want to be a successful individual investor, you need to know what you own and why you own it. If that makes you stand out from the crowd, then that is likely your edge even if it makes you feel completely vulnerable in the moment.

“The stock market is filled with individuals who know the price of everything, but the value of nothing.” - Phil Fisher

PetroChina - People often point to Buffett’s masterful investment in Apple, but the story that jumped out to me in the book is his less talked about investment in PetroChina. A $488 million investment made between 2002 and 2003 that turned into $4 billion by the time Buffett sold it between 2006 and 2007. That’s north of a 50% IRR, not too shabby especially with that sum of $. A commodity business located in China containing regulatory risk….yet Buffett saw a predictable cash generative business trading at only three times earnings that paid out 45% of the amount the company earned. This meant he generated a 15% cash yield on his investment. In 2008, Buffett said “I came to the conclusion it was worth $100 billion and it was selling for $35 billion. What’s the sense of talking to management?” Buffett trusted his own internal analysis after simply reading the annual report. Everyone knew about PetroChina ($35 billion market cap at time), but Buffett thought differently [uncommon sense as Munger called it] in order to reach his own personal conclusion that it was extremely undervalued.

“We look for one-foot bars to step over rather than seven-foot or eight-foot bars to try and set some record by jumping over” - Buffett, 1998

“When you were buying that block of stock [PetroChina], nobody else to speak of was buying. So, the insights can’t have been all that common. No, I think that takes a certain amount of…uncommon sense.” - Munger, 2004

Going against the herd requires fortitude, which can feel incredibly risky, but this is necessary if the goal is to outperform the market index. Personally, I currently feel this way holding EVO 0.00%↑, which has continually drawn down facing many short term headwinds including regulation uncertainty. However, I seemingly understand the business, accept the current risks, track the fundamentals, and continue to hold fast maintaining conviction that the company will continue to execute its long term vision.

Neuroscientists have shown that when humans do not conform that the amygdala - the part of the brain associated with fear - lights up. Few investors are willing to be a lone voice for fear of others ridiculing them. Do not take a contrarian position simply for the sake of being contrarian, but if you have done your own due diligence, have a compelling unique perspective, a goal that is different than the “market’s” then do not be afraid to stand out from the crowd. If you always invest in the latest market trends and fads, currently Mag 7, AI, big tech, etc., you will get the market return at best, there is really no way around that.

As I gain more experience, I hope to raise my conviction in building out contrarian positions. This could look like investing in a company prior to an inflection point, a pending catalyst, emerging trend, sour sentiment, etc. Meta’s META 0.00%↑ year of efficiency in 2023 is another great example of a contrarian, yet well calculated, investment as the core business was chugging along nicely the whole time yet sentiment had completely turned south. 1) Sentiment can change overnight in either direction! 2) Looking backward is not always a great forecast of the future. 3) Each case needs to be thought through independently of others.

“You really should not make decision in securities based on what other people think. If you’re doing that, you should think about doing something else. A public opinion poll with not get you rich on Wall Street. You want to stick with businesses that you feel you can evaluate yourself. We don’t read anything about what the economy or the market is going to do.” - Buffett, 1994

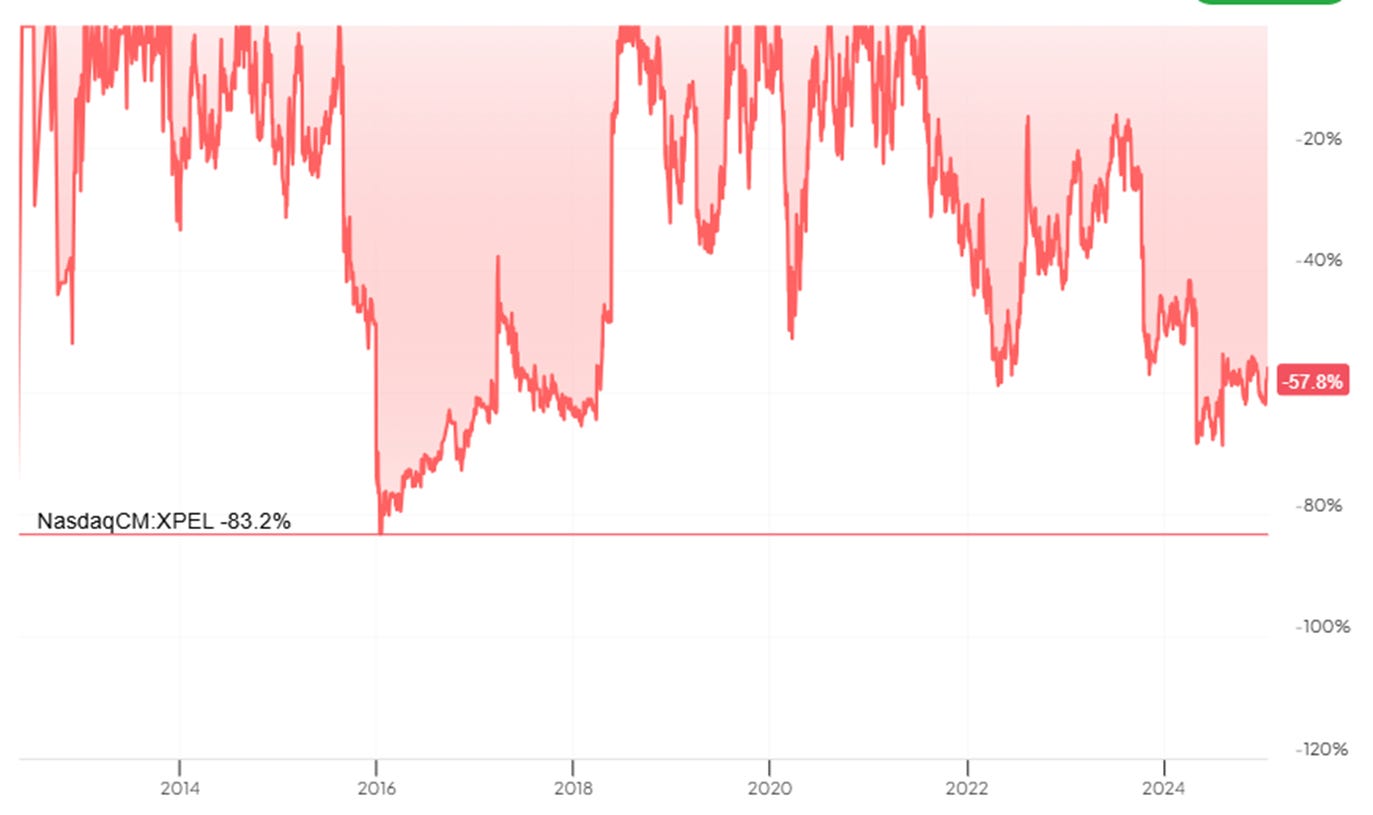

Unrelated to the Berkshire Unscripted book, but I wanted to highlight a specific example of this “independent mindset.” Below is a great story of Jason Hirschman investing in XPEL XPEL 0.00%↑ (beg 34:17), which represents an all time great investment. Long story short, he performed extreme due diligence getting to know management, customers, lawsuit research, chemical analysis, and many other types of tedious boots on the ground research.

Through his independent and contrarian mindset, Jason built out massive conviction to not only hold onto XPEL stock despite a massive lawsuit and a 83.2% drawdown, but to sizably add to his position. You have to know the company inside and out, understand the risks, and zoom out on the long term fundamental picture. Only then will you be able to stomach drawdowns, which inevitably will come for you. “Drawdowns are a privilege, it only comes to those who earn it.” Congrats to Jason as he generated a 9 figure return on this investment. Incredible story!

“Temperament is also important. Independent thinking, emotional stability, and a keen understanding of both human and institutional behavior is vital to long-term investment success.” ―Warren Buffett, Berkshire Hathaway Letters to Shareholders, 2023

Concentrated bets - One thing I think about a lot when listening to Buffett speak is that there is such a huge difference between young and old Berkshire. The modern Berkshire is so limited by its size, now being over a $1 trillion market cap. I am consistently amazed at how deftly Buffett has still been able to maneuver, i.e. the Apple bet, but the reality is in the very early years Buffett was absolutely feasting on returns, which is much more relatable to your average retail investor like myself. Much has been said about technological advances and the approach Buffett took is no longer replicable in today’s age, but I am convinced that Buffett would still be the best investor in the world today as well, albeit with a slightly different style, as the core of his philosophy is timeless.

I say all of that to say that the risk appetite of a younger Munger and Buffett was incredibly higher than what evolved later as their investable universe greatly shrunk. They trusted their analysis and skills, and worked relentlessly to find the diamonds in the rough, yet were also patient to wait on the fat pitches as well. I have long admired at just how much they enjoy business and the investing process as currently evidenced by them working into their late 90s. Generation of wealth is a much different game than preservation of wealth. They consistently mentioned about how they were not afraid to go in big with 40% weighted positions. Below are excerpts of this: [*Definitely not investment advice]

“We are willing to put a lot of money into a single security. When I ran the partnership, the limit I got up to was about 40% in a single stock. I think Charlie when you ran your partnership, you had more than 40%.”

- Buffett, 1998

“If you look at how the fortunes were built in this country, they weren’t built out of a portfolio of fifty companies.” - Buffett, 1996

“Several times I had 75% of my net worth in one situation.” - Buffett, 2008

I am learning this myself by building the necessary experience and confidence to place more concentrated bets as opposed to a bunch of 1%-2% positions. There is nothing wrong with taking a “starter position”, but I really want to know companies in depth, which owning more positions limits that ability. Secondly, when I find a winner, I want that winner to really matter to my portfolio return. This looks different to different people, but I have found 5%-10% positions to be an effective sweet spot that gives me strong upside while also protecting my downside, and from there letting my winners run.

Timeframe - Munger and Buffett seemed to always speak in 10 year intervals oftentimes even 20 years. They truly were owners of a collection of businesses. With that long term mindset, they knew speaking in quarters or even years was a fruitless proposition, but instead they knew that in the span of a decade plus, let alone multi-decades, the scales tipped in their favor with a huge margin of safety. Most investors, myself included, will buy a “stock” for the “long term,” but still be looking for a “pop” or get discouraged if it trades slightly down. Buffett rarely speaks as a stock picker, but almost always speaks as a business owner, which has allowed him to hold stocks for as long as he has throughout every imaginable market cycle. You do not naturally have this temperament as an investor, but this is a discipline that can be learned over time by locking in on the fundamentals of the business. With the crypto craze, meme-coins, and AI boom, this is as important now as ever. Buffett was almost always speaking in time increments of 10+ years with 5 years being the shortest length of time mentioned.

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” - Buffett, 1996

This mindset is so completely different than the verbiage of Wall Street. Buffett was a true long term business owner. He even delighted in lumpy quarters as long as the business was growing earnings overall.

Gyrations in Berkshire's earnings don't bother us in the least: Charlie and I would much rather earn a lumpy 15% over time than a smooth 12%. After all, our earnings swing wildly on a daily and weekly basis - why should we demand that smoothness accompany each orbit that the earth makes of the sun? - Buffett, 1996

This is not the magic trick advice we seek as investors, but it will serve us nicely as this leads to purchasing businesses with a high margin of safety made even safer by having long holding periods. Possessing this mindset allows you to find a business like American Express in the midst of a nationwide scandal, buy it at a bargain, and hold it for 60+ years. See below for the fascinating story of Rick Guerin, an original partner in Berkshire who wanted to get rich too quickly.

“Charlie and I always knew that we would become incredibly wealthy. But we were not in a hurry to get wealthy; we knew it would happen. Rick was just as smart as us, but he was in a hurry. And so actually what happened was that in the 1973-74 downturn, Rick was levered with margin loans. And the stock market went down almost 70% in those two years, and so he got margin calls, and he sold his Berkshire stock to me. I bought Rick’s Berkshire stock at under $40 apiece, and so Rick was forced to sell shares at … $40 apiece because he was levered…If you’re an even slightly above average investor who spend less than they earn, over a life time you cannot help but get rich, if you are patient.” - Buffett, 2008

“The world is overwhelmingly short-term focused. If you go to a quarterly call, they’re all trying to figure out how to fill out a sheet to show earnings for the current year.” - Buffett, 2023

Management incentives

“I think I've been in the top 5% of my age cohort all my life in understanding the power of incentives, and all my life I've underestimated it. And never a year passes but I get some surprise that pushes my limit a little farther.” - Munger, 1995

The above quote is one of the most important quotes I have ever read. The more experience I gain in investing, the higher the emphasis I need to place upon the quality of management and their capability to lead and adapt. Many aspects of the business and environment will change over time, however, the hands that steer the ship are likely not one of them. Obviously, Buffett steered clear of many of Wall Street norms, but it really was incredible of just how common sense the management practices instilled in the DNA of Berkshire. They truly valued their shareholders. This was and still is so counter cultural, but attracted a quality shareholder base that collectively has powered ahead for decades and likely for decades to come even after the passing of the torch.

I knew they would bash most of Wall Street’s practices, but it even surprised me reading back on just how many times they would emphasize the importance of their own management, while also rightfully criticize many ill-incentivized analysts, CEOs, comp committees, accounting practices, and even board members. It all comes back to common sense and serving multiple purposes with fair practices. It will serve us well as investors to find the Costcos of the world, who value each stakeholder (employees, suppliers, shareholders) and not just the companies who greatly enrich themselves with massive share dilution.

The quotes on the reinsurance were particularly interesting, of just how important it is to have a disciplined, long term approach to underwriting insurance premiums. This measured incentive approach forced them to sell far less insurance in certain market cycles, but overall was an incredibly profitable and winning strategy as many competitors eventually would blow up their balance sheets.

“Having the wrong incentives in insurance underwriting could be very harmful. At National Indemnity, premium volumes in 1980 were $79 million; in the ‘hard market’ of the mid-1980s, we got up to $366 million. And then we took it down — not intentionally, but just because the business became less attractive — from $366 million to $55 million. The market has become more attractive in the last few years, and it soared back up again to almost $600 million. I don’t think there’s a public company in America that would feel they could survive a record of volume going down like that, year after year after year [from 1986 to 2000]. But that was the culture of National Indemnity.” - Buffett, 2004

“It is very hard to shrink an insurance operation by 80% when the people who cone in every day don’t have enough to do, and it’s a counter-intuitive thing to do. But it’s absolutely required that you do it in a place where people go as crazy as they do in insurance.” - Munger, 2013

Berkshire has never set out with the goal of pleasing Wall Street. Despite the $1 trillion market cap, Berkshire still only has 6 analysts following the company compared to the 70+ AMZN 0.00%↑ or META 0.00%↑ has following them.

See’s Candies - It felt like Buffett would bring up See’s Candies at least once every annual meeting. This seemed to be the company that really helped mold his philosophy over buying quality companies that have pricing power due to endearing customer loyalty. Buffett and Munger bought See’s for $25 million (almost walked away from the deal as Buffett deemed it expensive), and it has returned over an estimated $2 billion in cash flow from 1972 to 2024. Not a bad return? Buffett constantly mentioned how wonderful business See’s was as it required minimal reinvestment and could outpace inflation by raising prices.

As wonderful as a business as See’s was (and many others), an even better business has the ability to redeploy capital at high rates of return, which See’s was limited in that regard. Buffett eloquently used See’s as a clear example to highlight returns of capital, which is what makes Buffett so great at distilling info down into such an easily digestible manner. You can make money in many different types of companies from capital intensive to capital light, but the best companies will generate high returns on incremental invested capital as Buffett has reiterated over many years.

We would love a business that could redeploy all of its earnings, or even well beyond the earnings: We’d love to have a business earning 20% on $100 million where, if we put another $1 billion in, it would earn 20% on that $1 billion. But those businesses are so rare…” - Buffett, 2003

“Charlie really did emphasize the qualitative much more than I did when I started. It makes more sense to buy a wonderful business at a fair price than a fair business at a wonderful price.” - Buffett, 2003

My mind goes to one of my holdings Dino Polska DINO 0.00%↑, a growing Polish grocery store operator. They have been expanding their store count from Eastern Poland to Western Poland, which have great economies of scale. We will see how long the company can execute this strategy, but for right now it is a beautiful display to see a company deploy 100% of their free cash flow into their core business with high returns of capital.

This is what makes Constellation Software CSU 0.00%↑ such a wonderful business in that they have been plowing all of their free cash flow into acquiring Vertical Market Software companies with incredibly high hurdle rates that produce ~25% IRRs. Easier said than done to discover these gems and manage them. The goal is of investing is clear, the process is not. Investing in companies with high returns on capital, low debt, and clear growth that have the ability to reinvest earnings into their business (unlike See’s) and generate high returns on those reinvested earnings will always leads to superior long term returns.

“Over the long term it is hard for a stock to earn a much better return than the business that underlies its earnings…if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive-looking price, you’ll end up with one hell of a result.” - Munger, 1994

Of course I had many more takeaways, but this book along with all the info that Munger and Buffett have passed down over the years is truly remarkable. Like so many others, I am incredibly grateful for their wisdom as I seek to compound my investing knowledge by continually studying their lessons. One last quote to leave you with.

“I constantly see people rise in life who were not the smartest, sometimes not even the most diligent. But they are learning machines…They go to bed every night a little wiser than they were that morning.”- Charlie Munger

Happy compounding, Poor Charlie

Wonderful write up, enjoyed reading nice refresh about independent thinking

Conviction in a stock and the patience to hold it for a long time is key.