My best friend in high school, and still to this day, was the type of person who was always picking up a new hobby. One week he wanted to be a cave tour guide in New Zealand, the next week an emu farmer, the following week a professional rock climber. You get the idea? I am the opposite personality type, which is why I ended up being an accountant and my best friend became a salesman, but I could always live vicariously through his exotic hobbies. One of those early ventures was that he became a Cutco knife salesperson in high school. Cutco knives are basically high end kitchen knives that are really sharp where salespeople can demo them and look to earn a commission. Naturally, as a 16 year old male does, my friend became a tad overzealous in his “knife demo” and ended up slicing his hand and needing stitches. I guess he demonstrated how sharp the knives were? Knowing him, he probably still completed that sale with blood and all.

Now rather than laughing at my friend’s misfortune, I would have been wise to learn a valuable lesson from that encounter. DO NOT CATCH A FALLING KNIFE. Only bad things will happen. It turns out that I did not learn that lesson as I attempted to catch two falling knives (stocks) myself. My last post (Fallen Angels) discussed temporary setbacks companies face that investors can take advantage of when focusing on the long term. Falling knives are companies that are facing long term challenges and deterioration in fundamentals. These setbacks are more sizeable than stubbed toes, but are more akin to broken legs, which will require extensive rehab and time to fully recover, if ever at all.

During late 2021, the COVID high of the market was starting to wear off, or you could even say the bubble was bursting. I saw certain stocks that were 50% off of their highs and thought to myself, “I am getting this great company at half the price it was cost previously. What a bargain! Investing is easy!” A valuable lesson was learned:

A company’s price could go up, and the stock actually be less expensive than before. A company’s stock price could go down, and the stock could actually be more expensive than before.

Falling knife - PayPal ( PYPL 0.00%↑ )

Now being relatively new to investing, I was certainly not smart, but also not a complete dummy. I obviously had heard of PayPal’s brand, seemingly had a good leader in Dan Shulman with high inside ownership, strong margin profitability, riding the secular consumer tailwind of electronic payments, fairly high returns on equity. My thesis was this was the type of slow, durable growth company that will take more and more market share as payments shift more to online as e-commerce grows each year. Also, I thought they could pull the grow lever and monetize the Venmo app which had 75 million users in 2022. Clearly the stock got out way ahead of itself and growth came to a screeching halt as the pricing multiple heavily compressed. No stock will work going from a P/E of 80 to a P/E of 14. Management was lackadaisical. Strategy was clearly misaligned with BNPL, superapp, crypto, etc., while the core business suffered. They even tried to acquire Pinterest for some inexplicable reason. The product tech was not innovating. Competition greatly ramped up. Hence, a falling knife and one of my most valuable lessons to date.

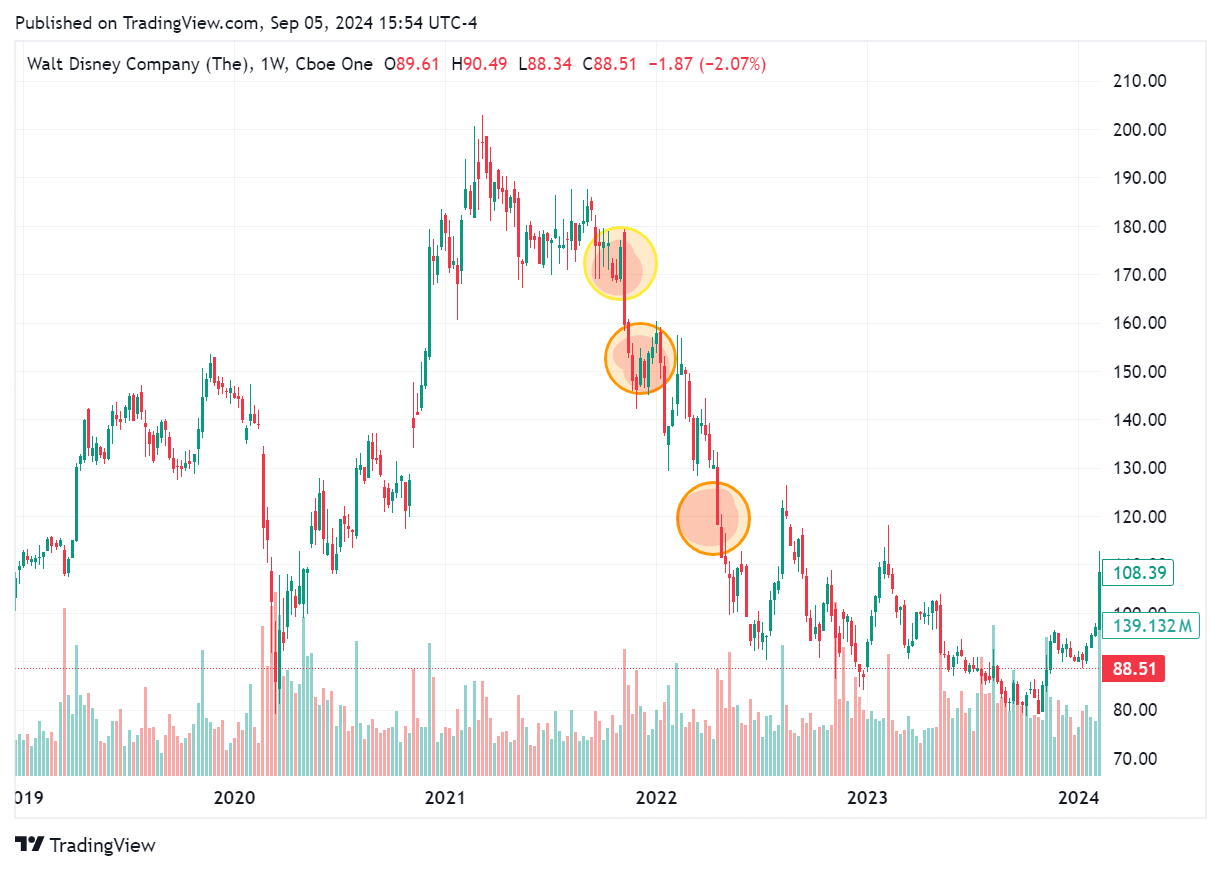

Those circles in the chart above may seem like buying opportunities in the moment, however, one should not stick their hand out when the stock is a falling knife as often there is more pain to come. Naturally, the next question is “Well, how do I know if the stock is a falling knife or a buying opportunity?” That my friend is one of the many arts of stock picking, but my suggestion is to always KISS (Keep it simple, stupid).

Just focusing on the core business metrics, you can see that transaction payment volume slowed along with the take rate compressing. COVID-19 pulled forward growth, but PayPal clearly lost sight on their efficiency and did not have the pricing power to maintain their margins as competition grew. All the above metrics signal a fundamental deterioration and complacent management with an unevolved legacy brand. Dan Shulman retired and a new CEO of Alex Chriss came over from Intuit, who has actually done an impressive job thus far largely because he has realigned focus on the core business parts. However, the damage has been done as the stock dropped from a high of $310 to a low of $50 for a ~84% decline. Ouch! Once a pandemic darling, this is now a turnaround story with a new CEO at the helm. Now, has the pendulum of investor sentiment swung too far negative and did PayPal become a bargain at $50 as the company has healthy margins and generates tons of free cash flow. Probably so, which is the wild ride of investing! Disc: I am still holding to let the story play out and the full lesson to sink in.

Lesson: Stocks can rapidly go from growth stocks to value stocks!

Here were my following purchase prices of PayPal from 2021-2022: $187, $173, $138, $118, $107, $67, $55). Multiple compression on a growth stock is killer. Now a P/E ratio of 14 may be too low for a company that still generates healthy free cash flow, but this was my lesson in just how quickly the tide of a narrative can dramatically shift from a growth story to mature business. Consider my tuition paid to the market as I have, hopefully, learned a valuable lesson.

If you polled the common person, and asked them which was the better company between eBay and PayPal, almost every person I venture would say PayPal, right? However, $1,000 invested into both PayPal $PYPL and eBay $EBAY on the day that PayPal became a public company after spinning out from eBay... eBay would now be worth $2,520 compared to PayPal's $1,889. Reminder, investing is hard.

Falling knife - Disney ( DIS 0.00%↑ )

Who doesn’t love Disney? One of the best brands in the world with tremendous intellectual property. Interestingly, Disney’s stock went from $78 to $201 in 2020 despite the fact that their parks were entirely closed for 4 months due to COVID-19 and the company suspended their dividend program. Then the stock cratered, which once again seemed like a generation buying opportunity. A dream legacy brand, met with a short term disruption in COVID-19. Ripe for the pickins, right? However, there were many fundamental challenges with Disney’s stock. Let me list some here:

Leadership problem - Bob Iger has repeatedly stepped away and came back to the company. Handpicked Bob Chapek to succeed him and then played a significant hand in firing him shortly thereafter. A leader cannot effectively lead if he cannot get out of his/her own way (Iger/Chapek beef).

Poor capital allocation - Disney paid $71.3 billion to acquire 21st century Fox’s entertainment assets in 2019. I do not need to do a deep dive analysis to conclude that is not going to generate near the same return as Disney’s $4 billion acquisition of Marvel in 2009 or $4 billion acquisition of Lucasfilm in 2012. Disney Parks is the gem of the business and deserves higher CapEx investment that has proven to generate high returns, but the company has plowed money elsewhere.

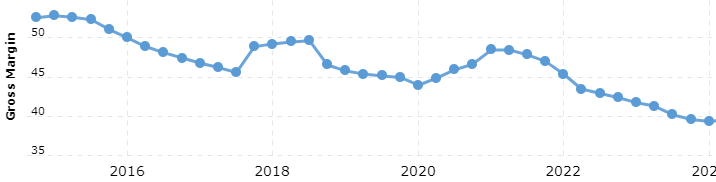

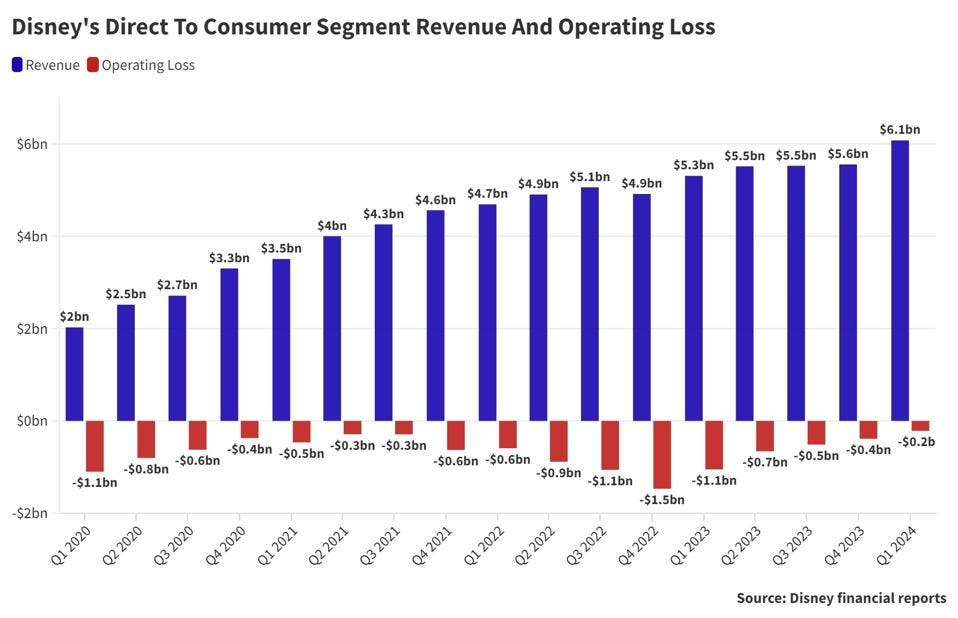

Strategy - Disney is in a challenging industry with linear TV steadily declining and the consumer pivoting to streaming. Disney + was slow to launch and did so very unprofitably, burning tons of cash to start. New content has largely not been high quality coupled with “superhero movie fatigue” (they made about 10-15 Marvel movies too many). The creative genius that has made Disney’s brand magical became algorithm driven and revenue focused, and just made lackluster content for a brand that depends on magic and ingenuity.

Broad focus - Strong company leadership is able to have narrowed, determined focus to reach it long term strategic goals. Aside from the internal turmoil mentioned above in #1, Disney has been wrapped up in lawsuits, cultural debates, negotiating with unions, and activist battles. All this while trying to run divisions of parks, cruise ships, hotels, linear television, streaming, ESPN, film creation, retail stores. Narrow the focus! At some point, all that weight and strategic misalignment seriously hampers a company’s overall growth.

Much more could be said about the challenges, suffice to say, a FALLING KNIFE. Yes, it has the brand and content, but it needs solid leadership, clear strategy, and seamless execution.

Falling knife - Cisco ( CSCO 0.00%↑ )

The first two falling knives I discussed above, I personally owned and caught the knife on the way down. The next one, Cisco Systems, I did not buy, however, I mention this stock because I did not buy the other side of the coin, which was an error of omission. Cisco’s competitor, Arista Networks (ANET 0.00%↑) , has been consistently gaining market share. Cisco was a victim of the dot-com bubble bursting back in 2000. The stock went from $55 down to $5. While that drop was more akin to a boulder being rolled off the side of the cliff rather than a falling knife, the business has been in a downturn for many years. Cisco competes against Arista Networks in the data center switch market. Arista Networks was a stock I had my eye on back in 2022 and one in which I erroneously did not buy while the price got away (far away) from me. Look at the change in market share and tell me which business has been winning since 2012. To the victor go the spoils.

In regards to a stock like Cisco, there will always be value cries over a “cheaper valuation”, or “Look at that dividend yield!”, new leadership, turnaround plan, acquisitions, divestitures, etc. Capitalism = Competition. Be wary of value traps and place your focus on the long term. Invest in companies that are clearly winning their respective markets, rather than falling knives. KISS. Arista Networks has been winning market share continually, which is why the stock has been a 22 bagger in the last 10 years since going public in 2014. The earlier you can identify the emerging leader gaining market share, the larger you can build out your position so that when the overall market can no longer ignore the winning company, you will be well positioned to reap the gains. You have a tremendous winner if you bought ANET 0.00%↑ any time from 2015-2020.

Falling knife - Dollar General ( DG 0.00%↑ )

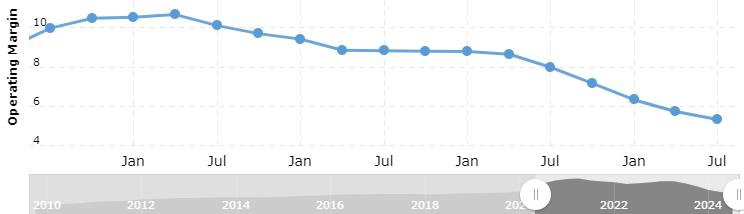

Dollar General is an interesting case study, because this had long been a steady compounder and one whom certain investors I respect are shareholders. This fits my criteria of a falling knife. The stock had gone almost perfectly up and to the right from 2009 thru early 2022, however, the pandemic clearly pulled growth forward while the fundamentals have struggled to keep up.

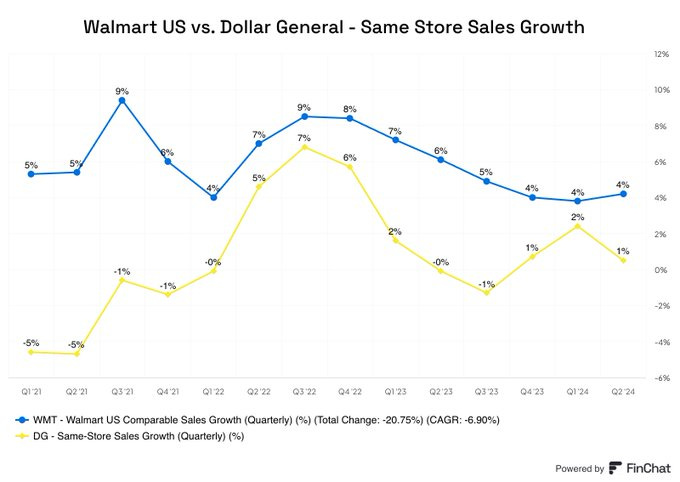

Dollar General (DG 0.00%↑) clearly lost strategic focus and overexpanded its store count. The company had previously grown same stores sales for 31 straight years, however, history is not always indicative of the future, which is why our jobs as investors are to constantly evaluate and verify the company’s path forward. Not to necessarily overreact to quarterly earnings, but also not lazily rely on past growth metrics and assume the future will remain constant and rest on those. Let us look at what has happened to Dollar General’s key performance indicators.

From my experience, you could walk into about any Dollar General store and tell just how poorly these are operated (dirty, disorganized, missing products, etc.). My oversimplified analysis would be that the company lost strategic focus as efficiency decreased, a clear leadership problem, poor product offering decisions (focused on consumer discretionary rather than core staples), lack of accountability, and most importantly competition greatly increased. Wal-Mart (WM 0.00%↑), the 800 pound gorilla, stepped in the ring and has subsequently dominated since Doug McMillon became CEO in 2014. Contrasting DG 0.00%↑ margins to WM 0.00%↑ , Wal-Mart has posted positive same store sale growth for the last 10 years straight while investing in their omnichannel of delivery and pickup service. Some low income shoppers are also opting for Temu, the online Chinese discount retailer, and even Amazon to a lesser extent. When in an incredibly competitive retail industry, you cannot afford to rest on your laurels, and that is precisely what Dollar General did and has now paid the price. In a low margin, highly competitive industry, every percent point is magnified and DG 0.00%↑ has clearly lost share.

Investing is all about purchasing stocks at a value that is below their intrinsic value today (see diagram below).

Seems simple enough, right? Even if you buy too high, you will eventually make money so far as the intrinsic value of the business rises. Now what if that red line above (intrinsic value) is trending down not up? At that point it does not matter at how much of a discount you purchase the stock at as the intrinsic value of the business will be lower in the future thus you will eventually lose money on your investment. Seems simple, but there is something in our human mind that signals you are getting more of a bargain when the price falls. I am trying to train my brain to scan the 52 week High list rather than the 52 week Lows. This is intellectually challenging for me. While a lower price may indicate less risk, this can also be highly misleading if growth is actually contracting or fundamentals are even deteriorating. You have to put in the work to always see the whole picture as much as you can. Money can only be made if setbacks are temporary (see FALLEN ANGELS) and the intrinsic value of the business will indeed be greater in the future.

Evaluating questions I am asking myself:

What is the company’s track record?

What is the severity of the setback?

What is the path forward to sustainable growth?

Conclusion: Value trap or opportunity?

Two other falling knife current case studies that I omitted, but find interesting are Nike (NKE 0.00%↑) and Match Group (MTCH 0.00%↑). These are two stocks that I looked at and listened to pitches on the brand and cheaper valuation, but there was too much there that had gone fundamentally wrong with the businesses for me to seriously consider an investment. Also, I never once heard their leadership take accountability with a clear execution path forward. Instead I heard about macro concerns, “weaker” consumer, change in metrics, and other excuses. Some other notable examples of past business downturns are companies such as Intel, Boeing, Paramount, IBM, Warner Bros, Walgreens, General Electric. As Warren Buffett succinctly said “Turnarounds seldom turn.”

Once again, as long term investors, we must dedicate ourselves to mastering the fundamentals. I am focusing my time and energy on finding high quality, wide moat, compounding businesses that are executing their vision. If I have identified these businesses correctly, then lastly I just need to be patient and disciplined enough to wait for the right price to buy them that ensures a margin of safety (see diagram above).

We think of genius as being complicated. But geniuses have the fewest moving parts..." - Peter Schjeldahl, art critic

Easier said than done. My goal is to do a better job at allowing falling knives to hit the floor rather than trying to stick my hands out to catch them. Preservation of capital is paramount in the long term game. Said another way, I want to water my flowers and cut out my weeds. Nature will do the rest.

Happy compounding,

Poor Charlie

- Feel free to comment below over any fallen knives that you have learned from in your investing life-

Another well written piece, poor Charlie. Probably my favorite to date, you do a good job at sharing practical lessons learned through story telling and humor.

I chuckled when I read “one should not stick their hand out when the stock is a falling knife as often there is more pain to come” because it made perfect sense coupled with the $PYPL graphic.

“If you polled the common person, and asked them which was the better company between eBay and PayPal, almost every person I venture would say PayPal, right?” - me, that’s me 🙋🏽♀️ I’m the common people that appreciate this closer look at the logic behind what you’re choosing

I enjoyed this read and even learned a little 😉

I wonder if that last sentence is a sneak peek to the theme next month 🌱

"If we become increasingly humble about how little we know, we may be more eager to search." - John Templeton